Cancer Charities Exec Stole $187 Million for Personal Use

Donors who have given money to four of the largest cancer charities in the United States may have unknowingly been financing the lavish lifestyle of the C.E.O. who runs them—paying for luxury cruises, elite gym memberships instead of treatment for cancer patients.

That’s according to a suit filed Tuesday by the Federal Trade Commission as well as attorneys general in all 50 states, which alleges that James Reynolds deceived and defrauded donors out of more than $187 million between four of his charities—including the Cancer Fund of America, Cancer Support Services, Children’s Cancer Fund of America and the Breast Cancer Society.

Related: Medicare Recovers Nearly $28 Billion in Fraud Since 1997

The complaint says that the scheme started in the 1980’s. The charities told donors via telemarketing calls that their money would go toward medicine and transportation for cancer patients. However, most of the money actually went toward Reynolds’ personal indulges.

The complaint says that between 2008 and 2012, only three percent of donations actually went to cancer patients.

The FTC also accuses the organizations of cooking their books and reporting inflated revenues as well as “gifts in kind” that they said they distributed internationally.

The FTC said two of the charities—the Children’s Cancer Fund of America and the Breast Cancer Society plan to settle the charges out of court. The Associated Press reported that the Breast Cancer Society, posted a statement on its website Tuesday blaming increased government scrutiny for the charity's downfall.

"While the organization, its officers and directors have not been found guilty of any allegations of wrongdoing, and the government has not proven otherwise, our board of directors has decided that it does not help those who we seek to serve, and those who remain in need, for us to engage in a highly publicized, expensive, and distracting legal battle around our fundraising practices," the statement said.

Several executives who were also involved in the sccheme, including Reynolds’ son, have agreed to a settlement, which bans them from working in fundraising or charities. The two charities that settled, Breast Cancer Society and the Children’ Cancer Fund of America will be dissolved.

The settlement also orders a $65,664,360 judgment, which is the amount consumers donated between 2008 and 2012. Reynolds junior’s judgment will be for suspended once he pays $75,000. Meanwhile the legal proceedings for Reynolds’ senior and the two remaining charities are ongoing.

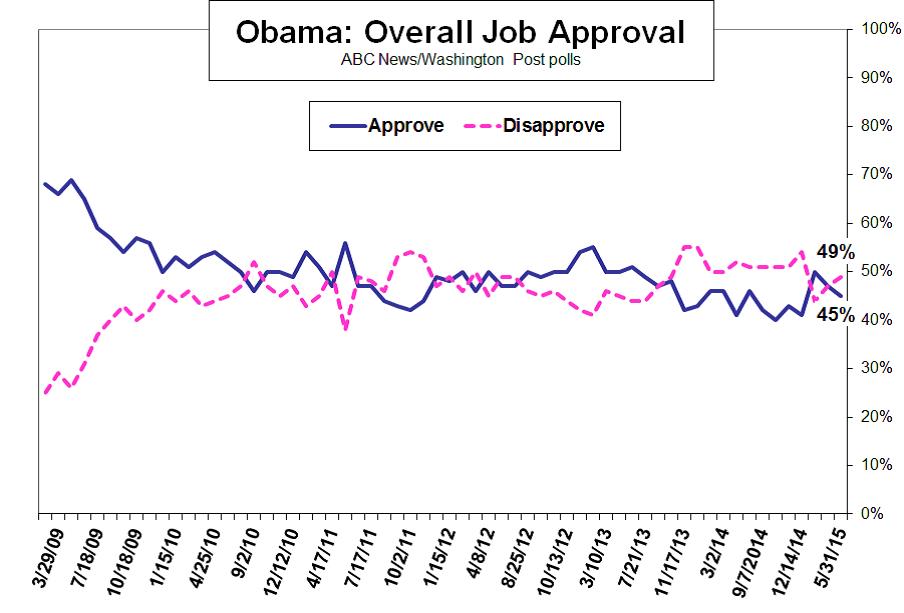

Obama’s Approval Tanks Over the Economy and ISIS

For a while, President Obama enjoyed a revival in popularity after years of public unease and displeasure with his stewardship of the economy and foreign policy. His approval rating jumped as high as 49 percent in mid-January, according to Gallup, and then tapered off a little amid renewed uncertainty about the economic recovery.

In the latest Washington Post/ABC News poll, however, 45 percent of Americans say they approve of Obama’s job performance, while 49 percent disapprove. That is his weakest rating in the survey since late 2014. The president effectively lost five points in approval since January and he hasn’t seen majority support since May 2013, according to survey analysis.

Analysts blame the decline in the president’s approval on continued economic anxiety at home – despite a drop in the unemployment rate to 5.4 percent in April and other signs of economic revival – and the advance of ISIS and other Islamic extremists in Iraq and Syria.

The condition of the economy consistently has topped the list of voters’ concerns heading into the 2016 campaign. The economic gains touted by the administration since the end of the Great Recession in June 2009 apparently haven’t been enough to calm fears, analysts say.

Seventy-three percent of those surveyed recently remain worried about the economy’s direction, and among them Obama’s approval drops to 35 percent, according to the survey. What’s more, Obama gets only a 31 percent approval rating specifically for handling the advance of ISIS militants, with 55 percent disapproving. Public approval of the president’s handling of the war against ISIS is 16 percentage points worse than his rating on handling the economy.

3 Dumb Moves That Can Hurt Your Career

What's the most common way to breach workplace etiquette and curb your career growth, if not derail it altogether?

AccountTemps says employers and staffers don't always see office etiquette the same. But bosses certainly have more leverage in the matter, since they can fire employees who buck the rules, and a company survey finds U.S. chief financial officers are most often bugged by workers "being distracted" on the job (27% of CFOs say so) and "gossiping about colleagues" (18%).

Other top offenses cited by CFOs:

- Not responding to calls or emails.

- Being late to meetings, or missing them.

- Not crediting other staffers when appropriate.

Employers and workers may not see the top etiquette breaches equally, but they agree on professional decorum more than they disagree, and the shared message is easy to sum up: "Most jobs today require teamwork and strong collaboration skills, and that means following the unwritten rules of office protocol," says Bill Driscoll, a district president of Accountemps. "Poor workplace etiquette demonstrates a lack of consideration for coworkers."

Related: Modern Etiquette: Outclassing the Competition

Of course, the list of workplace professional breaches exceeds the AccountTemps list.

"I've seen it all," notes Nicole Williams, a workplace consultant and a career contributor to NBC's The Today Show. "Employees who lie on expense reports; who badmouth the company or boss on social media or to clients; proofreading mistakes; missing deadlines. Just to name a few."

If you do trip up on the job, it's best to be accountable. "If you really screw up, you have to suffer the consequences in silence," Williams says. "Don't protest, don't try and get out of it, and don't put the blame on someone or something else. People will respect you more for owning your mistakes."

This article originally appeared on Main Street

Read More from Main Street

- 10 Ways to Blow a Job Interview

- The 10 Worst Cities to Enjoy a Summer 'Staycation'

- 12 Universities with the Biggest Endowments

Read more from Main Street: - See more at: http://www.thefiscaltimes.com/2015/05/19/Why-Even-Rich-Millennials-Are-F...

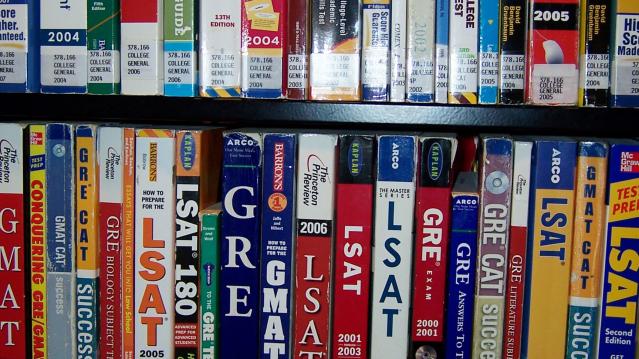

The Lucrative Business of SAT Test Prep Is About to Get Disrupted

For years, critics of the SAT have claimed that wealthy students who can afford expensive, private test prep courses have a leg up on poorer students without access to such classes.

That just changed. Starting yesterday, all students can access free, high-quality online test prep via a new partnership between the College Board, which administers the test, and online course powerhouse Khan Academy, a nonprofit supported by the Bill and Melinda Gates Foundation and Ann and John Doerr among others. The online program will include quizzes, video lessons and personalized lessons.

The Official SAT Practice will focus on the recently redesigned SAT, with questions created by the tests’ authors.

Related: SAT Tests: Another Drain on the Family Budget

College test preparation is a $4.5 billion business. Private SAT tutors charge in excess of $100 per hour and classes from companies like Kaplan or Princeton Review run about $1,000. And those classes may help. Students from the wealthiest families have average test scores that are more than 300 points higher than students from the poorest families on average, according to the College Board.

In recent years, more colleges have moved away from the SAT and its competitor, the ACT, as a backlash against the tests have grown.

More than 850 schools have made the tests optional for admission, according to advocacy group FairTest, choosing instead to focus on class grades and other factors. A study released last year of undergrads at those schools found no difference in either the GPAs or the graduation rates of students who took the SATs versus those that skipped it.

Gas Prices This Summer Could Be Cheapest Since 2009

Gas prices have been on a tear in recent weeks, hitting a national average this week of $2.75 per gallon, the highest price this year, but they’re poised to fall back down as the summer progresses, according to AAA.

The organization is predicting that the cost of gas could fall to its lowest levels since 2009, which is good news for travelers ready to hit the road. About 60 percent of Americans recently surveyed by AAA said they were more likely to take a long road trip this year is gas prices remain low.

While the national average price of gas remains well below $3 per gallon, and 87 percent of U.S. stations are selling gas for below that benchmark, consumers out west and in Hawaii are paying more. Prices in California are highest at $3.30, followed by Hawaii ($3.70) and Nevada ($3.30).

Related: Gas Prices or Economy, Experts Disagree on What Drives U.S. Demand

The average price for a gallon of gas last month was $2.69 per gallon, nearly a dollar less than the $3.66 it cost last May. Economists have been hoping for months that low energy prices would boost consumer spending, but Americans have been choosing to sock away their extra cash rather than spending it.

Personal spending was basically flat in April, falling less than 0.1 percent despite a slight increase in personal income. At the same time, the savings rate increased from 5.2 to 5.6 percent.

Millennial Women are Taking Charge—at Work and at Home

According to a recent report from U.S. Trust, women at the top of the earnings ladder are not only making strides in the workplace, but they’re also taking charge of their households’ finances at higher rates.

The national survey of 640 adults found that among high-net-worth individuals—defined as those with at least $3 million in investable assets—30% of Gen Y women are breadwinners in their households, and another 21% contribute the same amount of income to the household as their partners.

Perhaps even more surprising? That’s true for Millennial women more than any other demo.

Related: How Millennials Could Damage the U.S. Economy

Compare that to the 11% of Gen X women and 15% of Baby Boomer women who earned more than their husbands.

Likely a result, young women have a greater influence over their family’s money decisions than ever. Among today’s high-earning female Millennials, 31% are the primary decision-makers when it comes to their household’s wealth and investment planning. That’s considerably more than the 11% of Gen Xers and 9% of Boomer women who can say the same.

Of course, these role changes don’t just affect women. As moms continue to earn more, about one in four Millennial fathers are more likely to be the primary caretakers of their children—a striking difference from the 7% of Gen X and 3% of Boomer dads who’ve undertaken the same responsibility.