Cyber Thieves Hit the IRS—and 100,000 Taxpayers

Identity thieves hacked into an Internal Revenue Service data system earlier this year, potentially gaining access to personal financial information for at least 100,000 taxpayers.

The IRS issued a statement today saying that its online system, “Get Transcript,” was breached between February and May, the Associated Press first reported. The portal possesses information including tax returns and other taxpayer data stored by the IRS.

Related: Tax Thieves Could Boost Their Income by 262 Percent

The IRS’s statement said the tax thieves were able to penetrate the system because they had knowledge of 100,000 taxpayers, including dates of birth, Social Security numbers and tax filing details.

The massive hack comes as identity theft is at a record high. Earlier this year, the Treasury Inspector General for Tax Administration (TIGTA) reported that 1.6 million taxpayers were affected by identity theft in 2014 – compared to just 271,000 in 2010.

The IRS’s ability to catch fraudsters was even added to the GAO’s “High Risk List” or the list of federal programs that are most-vulnerable to waste, fraud and abuse.

Auditors attribute the increase to the uptick in electronic filing, which is more convenient for tax filers, but also easier for fraudsters to file fake returns.

TIGTA says the IRS doled out more than $5.8 billion in fraudulent refunds related to identity theft during the 2013 filing season.

The shift to electronic filing is also apparently making taxpayer information even more vulnerable according to the latest breach.

Related: IRS Struggles to Help Victims of Identity Fraud

The hack is obviously bad news for the agency, which is already struggling to address cases of identity theft as they stack up. TIGTA reported the IRS took about 278 days on average to resolve identity theft cases in 2013, despite the agency claiming that it takes about 180 days or six months to resolve issues of identity theft.

When it does complete cases, the IG found that about 10 percent of the “resolved” were riddled with errors.

The latest report comes at a tough time for the IRS, which is struggling with a recent round of budget cuts and is operating with an even greater workload while enforcing at least 40 new tax provisions under the president’s health care law.

The agency said it has temporarily suspended the online service that was the subject of the breach until the vulnerabilities are resolved.

Top Reads from The Fiscal Times:

- Mike Huckabee and His Tax Plan Get Slammed on Fox

- Putin Isn’t Reviving the USSR, He’s Creating a Fascist State

- States Band Together To Keep Obamacare Afloat

Why U.S. Productivity May Be Worse Than We Think

The new economy may be making it easier for people to work from home and in other non-office settings, but it isn’t necessarily making us more productive.

This week, the Bureau of Labor statistics released new data, which showed that Americans spent more time working last year than at any time in the survey’s 12-year history. However, employers aren’t paying workers for those additional hours worked, according to a new research note from Michael Feroli, Chief Economist at J.P. Morgan

That’s bad news for workers, who are doing additional work without earning any additional compensation, but it’s also bad news for the economy. The BLS measures productivity growth (output divided by hours worked) based on the number of hours reported by the employer.

Related: The Do’s and Don’t’s of Boosting Your Productivity

Even by that measure, productivity expanded just 0.6 percent per year from 2010 to 2014, compared to 2.1 percent per year from 2003 to 2009. But when looking at productivity growth based on hours worked from an employees’ perspective, productivity has remained totally flat since 2010, according to Feroli.

What’s behind the discrepancy? Feroli writes that it may have to do with the way we work in today’s economy. “Technology can tether one to the office every minute of the day and in every place, regardless of whether the employer pays for that degree of connectedness.”

How Snapchat Wants to Win the 2016 Election

Snapchat is getting a lot of attention for its presidential ambitions.

In an effort to both appeal to the youth vote and bolster its events coverage built on a growing volume of video posted by its users, the app recently posted a job opening for a Content Analyst in Politics & News.

The new hire will curate photos and videos for the app’s “Our Story” curated events coverage of the presidential race and other news events. That stories feature has already proven to be a massive success. On average, Snapchat’s Our Stories draws around 20 million people in a 24-hour window, director of partnerships at Snapchat, Ben Schwerin, told Re/code. The three-day story in April about Coachella, the music festival, generated 40 million unique visitors.

Political events might not be draws on that same scale, but Snapchat apparently believes its massive influence with younger Americans could attract millions millennials to engage in the political process at a time when voter turnout is at its lowest levels since World War II. In the 2012 mid-term election, the national turnout rate was 35.9 percent. Of that, only 13 percent were between the ages of 18 and 29.

Related: Can ‘Project Lightning’ Give Twitter a Fresh Jolt?

Boasting more than 100 million daily users, Snapchat is valued at $16 billion — giving it the reach and the financial clout to become a force in 2016 campaign coverage. About 60 percent of U.S. smartphone users aged between 13 and 24 have used the app, according to The Financial Times. The largest demographic of users is between the ages of 18 and 24 (45 percent), followed by those between 25 and 34 (26 percent).

To capitalize on that user base, Snapchat recently hired former CNN political reporter Peter Hamby to oversee its expanding news team. Snapchat wants to promote content from debates, rallies, appearances and other election events and allow users to follow along. But this isn’t purely an experiment in civic participation. Candidates can pay for political ads to appear on the social media app.

The social media app has an ace up its sleeve to incentivize candidates to purchase ads. The app already has age-gating technology and a form of geographic targeting. Originally put into place to make sure underage kids wouldn’t see alcohol ads, the age gate could be used to reach only voting-age users. The geographic targeting allows Our Stories to only be viewable by people in the same city or area, so politicians could target specific areas, especially ones in a tight race.

Snapchat, best known as the service that allows users to send disappearing photos, claims that ads inserted into “Our Stories” have an advantage over other social media advertisements because they leave more lasting impressions.

If campaigns buy into that and turn to Snapchat as a way to connect with a hard-to-reach demographic, the social media company could be the big winner in the 2016 election.

Coming Soon: Free Wi-Fi From Google’s Sidewalk Labs

Google’s latest startup wants to use technology to improve city life.

Google is about to hit the streets with Sidewalk Labs, a Google startup that will focus on developing new technologies to improve urban life. Billing itself as an “urban innovation company,” Sidewalk Labs was founded to tackle urban problems such as housing, pollution, energy consumption, and transportation with the goal of making cities “more efficient, responsive, flexible and resilient.”

The first project? In New York City, LinkNYC will replace aging pay phones with slim, aluminum pillars that provide free high-speed Wi-Fi. The hubs also will allow people to charge their mobile devices and look up directions on touch screens. Qualcomm will be the wireless provider

Related: Why Google’s Internet Balloons May Be a $10 Billion Business

According to the Federal Communications Commission, 17 percent of the population, or 55 million people, in the United States don’t have access to high-speed broadband. Sidewalk Labs hopes that projects like LinkNYC can help bridge that gap.

For the LinkNYC initiative, Google acquired and merged two companies -- Control Group and Titan -- into a new venture called Intersection, which aims to provide free, public Wi-Fi in cities around the world using such familiar urban infrastructure as bus stops and pay phones.

Related: Google Spends More Than Any Other Tech Giant to Influence Congress

Daniel L. Doctoroff, a former Bloomberg CEO and deputy mayor for New York City, has been tapped to head Sidewalk Labs. Doctoroff, who conceived the idea for Sidewalk Labs with a Google team headed by CEO Larry Page, told Wired, “The vision really is to make cities connected places where you can walk down any street and have access to free ultra high speed Wi-Fi. The possibilities from there are just endless.”

Just don’t give us any automated, self-driving taxis, please.

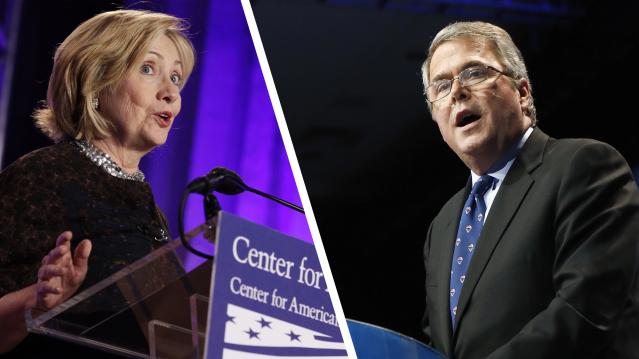

Presidential Candidates Respond to SCOTUS Obamacare Ruling

The Supreme Court’s 6-3 ruling Thursday may have kept the health care law and its insurance subsidies in place, but that doesn’t mean Republican efforts to “repeal and replace” the law are done. Major GOP presidential candidates took to Twitter following the Supreme Court’s announcement to blast the high court’s decision. Here are their responses and those from the Democratic candidates.

I am disappointed in the Burwell decision, but this is not the end of the fight against ObamaCare. http://t.co/3yaEVF1TaW

— Jeb Bush (@JebBush) June 25, 2015

Yes! SCOTUS affirms what we know is true in our hearts & under the law: Health insurance should be affordable & available to all. -H

— Hillary Clinton (@HillaryClinton) June 25, 2015

Despite the Court’s decision, ObamaCare is still a bad law that is having a negative impact on our country and on millions of Americans.

— Marco Rubio (@marcorubio) June 25, 2015

Justice Scalia got it right! "Words no longer have meaning if an Exchange that is not established by a State is "established by the State."

— Dr. Rand Paul (@RandPaul) June 25, 2015

I remain fully committed to the repeal of Obamacare—every single word of it. And, in 2017, we will do exactly that https://t.co/6i4WzLFzKR

— Ted Cruz (@tedcruz) June 25, 2015

#ObamaCare ruling is judicial tyranny. http://t.co/Di6WjxOc3y

— Gov. Mike Huckabee (@GovMikeHuckabee) June 25, 2015

Now that this ideological attempt to stop #ACA failed, we must redouble our efforts to bring health care to every person in this nation.

— Martin O'Malley (@MartinOMalley) June 25, 2015

Americans deserve better than what we’re getting with Obamacare. It’s time we repealed and replaced it! http://t.co/1EHfbVKBMa

— Rick Perry (@GovernorPerry) June 25, 2015

It is outrageous that the Supreme Court once again rewrote ObamaCare to save this deeply flawed law https://t.co/NBAnohFTW7

— Carly Fiorina (@CarlyFiorina) June 25, 2015

RT If you agree. We need real leadership in Washington, and Congress needs to repeal and replace #ObamaCare. #SCOTUScare - SKW

— Scott Walker (@ScottWalker) June 25, 2015

NEWS: Sen. Bernie Sanders' statement on Supreme Court decision upholding #ACA http://t.co/AUQgEHqUsi pic.twitter.com/PjyEillVBa

— Bernie Sanders (@SenSanders) June 25, 2015

Deeply disappointed by #SCOTUS ruling. Fundamental increase of govt control. I'm working to ensure next Pres repeals and replaces #Obamacare

— Dr. Ben Carson (@RealBenCarson) June 25, 2015

Today's Supreme Court ruling is another reminder that if we want to get rid of #Obamacare, we must elect a conservative President #RICK2016

— Rick Santorum (@RickSantorum) June 25, 2015This Is America’s Biggest Financial Fear

More than 60 percent of Americans are losing sleep at night because of financial concerns, and the biggest concern is that they’re not saving enough for retirement, according to a new report from CreditCards.com.

The second-biggest worry is about the cost of education, with half of those between the ages of 18 and 29 saying that concern keeps them up at night.

The percentage of Americans worried about education costs has been growing for the past eight years and is the only category that has become a bigger problem since the Great Recession. “Unless something slows the rapid rise in college costs, this could soon be Americans’ biggest financial fear,” CreditCards.com senior analyst Matt Schultz said in a statement.

Related: 12 Smart Money Moves Millennials Should Make Right Now

That echoes a Gallup poll released in April, which found that 73 percent of parents with kids under age 18 ranked paying for college as a financial worry, more than were concerned about saving for retirement or covering medical expenses.

Nearly one in three Americans are losing sleep because of medical bills, 27 percent are worried about their mortgage or rent payment, and 21 percent fret over credit card debt.

Older Americans and those with higher incomes seem to have fewer financial anxieties than younger generations. Less than half of those age 65 or older are losing sleep over their finances, versus more than two thirds of adults 64 or younger. Of those making less than $75,000 per year, 69 percent had financial worries, compared to just 51 percent of those making more than $75,000.