Looking to Buy a Home? Do This First

Buying a home is stressful enough without getting blindsided with a higher-than-expected rate on your mortgage — or outright rejection — due to a low credit score or errors on your credit report.

Even so, only half of recent home buyers said they checked their credit report early on in the homebuying process, according to a report released by Experian.

That can make for some nerve-wracked meetings with lenders. About a third of those surveyed said that their credit score surprised them, and a fifth of buyers said their score was lower than expected. Fourteen percent of homebuyers found something negative on their credit report that they didn’t know about.

Related: Why Your Credit Score Is the Most Important Number in Your Life

A low credit score can have costly consequences. A borrower with a FICO score of 760, for example, would pay $1,360 per month on a $300,000 loan, while a borrower with a score of 759 would pay $1,397 per month on the same loan. That difference will add up to more than $10,000 over the life of a 30-year mortgage.

Forty-five percent of future homebuyers surveyed by Experian said that they had delayed purchasing a home in order to work on their credit and qualify for better rates.

If your score is lower than expected, first check the report for errors and contact the credit bureaus about correcting them. If you’ve been dinged for a single missed payment, call your credit card company to see if it will remove the incident from your reports. Then focus on making on-time payments and paying down any high balances to get your debt-to-income ratio below 25 percent.

Wages Are Finally Going Up, Sort of

Average hourly earnings last month rose by 2.9 percent from a year earlier, the Labor Department said Friday — the fastest wage growth since the recession ended in 2009. The economy added 201,000 jobs in August, marking the 95th straight month of gains, while the unemployment rate held steady at 3.9 percent.

Analysts noted, though, that the welcome wage gains merely kept pace with a leading measure of inflation, meaning that pay increases are largely or entirely being canceled out by higher prices. “The last time unemployment was this low, during the dot-com boom, wage growth was significantly faster — well above 3.5 percent,” The Washington Post’s Heather Long wrote. The White House Council of Economic Advisers this week issued a report arguing that wage gains over the past year have been better than they appear in official statistics.

Cost of Trump’s Military Parade Rising Fast

It looks like President Trump’s military parade is going to cost a lot more than the initial estimate suggested – about $80 million more.

The Department of Defense pegged the cost of the parade at roughly $12 million back in July, but CNBC reported Thursday that Pentagon officials have increased their estimate to $92 million. The total consists of $50 million from the Defense Department and $42 million from other agencies, including the Department of Homeland Security.

The parade, which President Trump requested after attending a Bastille Day military parade in Paris last year, is scheduled for November 10 and will reportedly include aircraft, armored vehicles and soldiers in period uniforms. Abrams tanks, which weigh roughly 70 tons apiece, will also be included, CNBC said, despite concerns about heavy military equipment ripping up the streets of Washington. A Pentagon analysis apparently found that the armored vehicle’s treads would not cause any damage.

The parade is expected to begin at the Capitol, continue past the White House and end at the National Mall, according to earlier reports from NBC News.

Quote of the Day: Time to Raise Taxes?

“Tax revenue as a percentage of gross domestic product is expected to be 16.5 percent next year. The long-term average in a full-employment economy is 18.5 percent of GDP; if revenue were at that level for the coming decade, debt would be $3.2 trillion lower and the 10-year fiscal gap would be halved. Returning to past revenue levels, however, will be inadequate over time, because an aging population will increase Medicare and Social Security costs. This need not pose a problem: Revenue was roughly 19 percent of GDP in the late 1990s, and economic conditions were excellent.”

– Former U.S. Treasury Secretary Richard E. Rubin, writing in The Washington Post

Quote of the Day: When Tax Cuts Pay for Themselves

“You … often hear the claim that a lot of tax cuts will ‘pay for themselves,’ that they’ll cause so much additional economic activity that the revenue feedback from that activity will fully offset the direct revenue loss caused by the tax cut so that you end up making money for the federal government, or at least not losing any money. Now, of course that is theoretically possible and it would happen at extreme rates. I mean if a country had a 99 percent flat rate income tax and lowered it to 98 percent, I believe that they almost certainly would collect more revenue at the 98 percent rate than they did at the 99 percent rate. But the idea that this type of effect would occur at today’s tax levels just requires responses that are much bigger than statistical evidence would support and I think much bigger than common sense would indicate if you just ask people how they themselves would react to the tax cut.”

-- Alan Viard, tax policy expert at the American Enterprise Institute

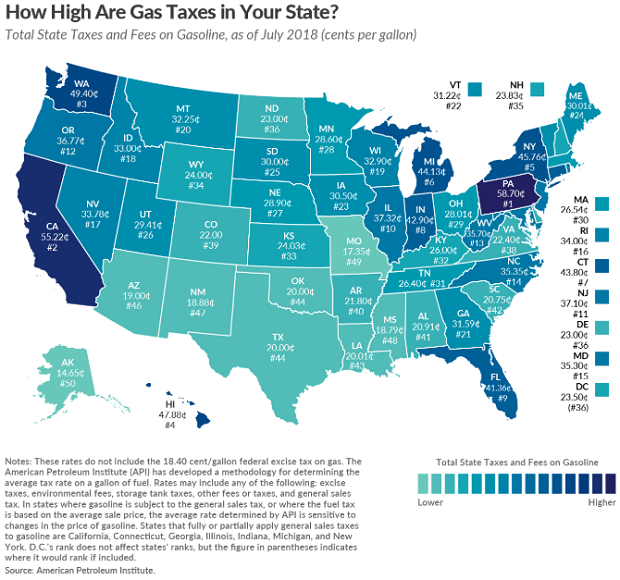

Map of the Day: Gas Taxes

It’s summertime and the driving is anything but easy if you want to get to your favorite beach or mountain cabin for a well-deserved break. As lawmakers consider a plan to raise federal fuel taxes by 15 cents a gallon, here’s a look at the current state-level taxes on gasoline, courtesy of the Tax Foundation: