Over the last few weeks, it seems like all of Wall Street has fallen asleep. Or perhaps gone on an early summer vacation. The Dow Jones Industrial Average has settled back toward 18,000, a threshold first crossed back in December.

The swings in crude oil have died down as well. Back in January, energy price weakness dragged down the entire stock market as energy stocks were slammed. But West Texas Intermediate has been in stasis since late April near the $60-a-barrel level.

Is the 42 percent rally in crude sustainable? Or is a retest of the lows in order? As I explained in a recent article, I believe near-term weakness is the most likely outcome as Saudi Arabia ramps up production in an apparent second wave attack on the U.S. shale industry.

Related: Why a New Age of Nuclear Energy Is About to Dawn

Much depends on the outcome of an upcoming meeting of the Organization of the Petroleum Exporting Countries, or OPEC, on June 5. Saudi Arabia, OPEC's swing producer, has made no secret of its desire to crush the U.S. shale industry via a price war in order to recapture market share.

That task remains incomplete as both prices and U.S. shale activity rebound.

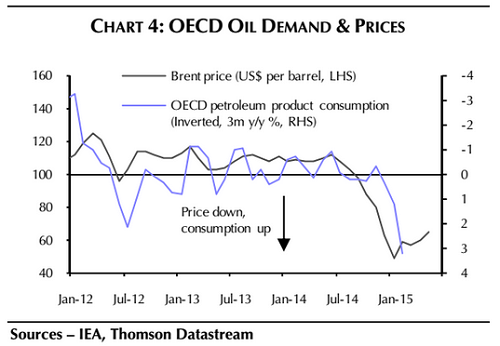

Prices have been helped by the seasonal start of the summer driving season. And, as to be expected, increased U.S. demand during this time is helping to slowly draw down still high inventory levels — which has been the central factor driving the March-May oil rally.

U.S. oil production rose to a new high of 9.6 million barrels per day in the week of May 22, which is the highest level since weekly data started in 1983. That's a sign shale producers, which idled unproductive rigs but kept production high during the price squeeze earlier in the year, are eagerly uncapping wells.

Data show production out of the Bakken shale in North Dakota rose in March for the first time this year. And a recent article in the National Post highlighted a "fracklog" of drilled-but-untapped wells (totaling 4,731 in the United States) that are just waiting to come online should prices keep rising. A similar dynamic is in play in Canada as well.

Related: Fracking Has Made Oklahoma the Earthquake Capital of the U.S.

Nomura analyst Theepan Jothilingam warns that investors who bought into the energy sector during the rally out of the March low may have jumped the gun. This is because big oil companies like Exxon Mobil (XOM) have a cost curve — that is, their average cost of production — that’s still "sticky" on the more expensive end of the spectrum compared to the main OPEC producers and U.S. shale plays.

In other words, the oil industry has not fully adapted to a world of lower energy prices yet. Sure, the U.S. drilling rig count is down 60 percent since peaking late last year. But one gets the feeling oil executives and oil investors both believe higher prices are just around the corner.

Capital Economics notes that Friday's OPEC meeting is likely to be as closely watched as the previous gathering in November, when the oil cartel decided to hold production steady, pushing the physical market into oversupply and precipitating the sharp decline in energy prices.

A production cut is unlikely now, as OPEC is just beginning to see demand for its oil increase — something Iran's oil minister hinted at in comments late last month.

Moreover, the U.S. Energy Information Administration expects output from U.S. shale wells to fall this month and next for the first time since oil prices started sliding last year. Efforts to push down prices are just beginning to bear fruit.

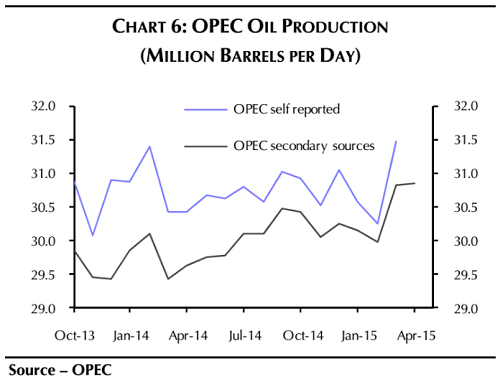

Actions speak louder than words. And right now, OPEC oil production is ramping up in a big way as the sheiks in Riyadh work hard to keep their sandals on the throats of U.S. oilmen.

The wild card is the outcome from the nuclear negotiations between Iran and the West later this month. A deal could unlock economic sanctions and eventually bring an additional 1 million barrels of Iranian crude into the market. Tehran produced as much as 4 million barrels per day as recently as 2008, but has seen output fall to around 2.8 million barrels a day now.

Related: What's Next for Oil Prices? Look Out Below!

If OPEC were to make any production cut to compensate for additional pumping by the Iranians, it would need to come from Saudi Arabia because of the fractious nature of the cartel. But that's very unlikely given that Riyadh and Tehran are embroiled in a religious proxy war on multiple fronts throughout the Middle East. If the Saudis cut output now, they would just be gifting market share (and revenue) to their competitors in the United States and across the Persian Gulf. This was the lesson learned in the 1980s, when OPEC production cuts resulted in a boost to British and Norwegian producers operating in the North Sea.

From the Saudis’ perspective, cheaper oil is in their best interest in what is a rare alignment with the desires of American drivers.

Top Reads from The Fiscal Times: