Millennials Like Saving Money, Want to Save More

Millennials have impressive financial habits when compared to baby boomers, according to a new Retirement Saving & Spending Study by T. Rower Price. Millennials like to save, with many taking advantage of 401(k) plans while still paying down debt. On average, millennials are saving nearly as much for retirement -- 8 percent of their incomes -- as baby boomers, who are saving an average of 9 percent. And in the past 12 months, millennials are saving a higher percentage of their incomes than baby boomers when it comes to 401(k) contributions.

The research is based on online interviews with 1,505 millennials and 514 baby boomers with 401(k)s, and includes both workers and retirees.

Overall, millennials in the study report they are in surprisingly good financial shape. Eighty-eight percent say they are living within their means and 74 percent are more comfortable saving and investing extra money than spending it. However, many millennials are pessimistic about Social Security: Sixty percent expect Social Security to go bankrupt before they retire.

Here’s what else the survey reveals:

Millennials like to save, and they’d save more if they could.

Saving for retirement and paying down debt are equally important to millennials, who rank both goals as a top priority. For those who say they are not saving enough, 23 percent cited student loans as a major contributing factor.

Related Link: ‘Irresponsible’ Millennials Saving More Than Almost Every Other Group

Millennials like auto-enrollment plans.

Seventy-nine percent of the millennials who were auto-enrolled in 401(k) plans were satisfied with auto-enrollment. When it comes to 401(k) matches, 59 percent of millennials set their 401(k) contribution rate to take full advantage of their employers’ matches.

They’re open to advice and more likely to ask for help if they need it.

If faced with a sudden financial emergency, 55 percent of millennials said they’d seek the help of family and friends, compared to 24 percent of baby boomers. Millennials were also much more likely to admit they could benefit from help with spending and debt management.

They find it hard to save when they make less money.

Non-savers made less money and carried more student debt. The median personal income of non-savers was $28,000, compared to $57,000 for savers. Thirty-nine percent of the non-savers have trouble meeting their monthly expenses.

Men save more.

Millennial women are less likely to save in 401(k)s, even if they are eligible, and when they do, they save less than men. The average 401(k) balance for women participating in their 401(k) is $38,000, compared to an average 401(k) balance of $74,000 for men. Of those who are already participating in 401(k)s, only 41 percent of the savers are women.

Related link: Here Are 7 Ways People Screw Up Their 401(k)s

Americans Just Went on a $32 Billion Credit Card Shopping Spree

Americans may be heading for another credit card crunch. After paying down almost $35 billion in credit card debt in the first quarter of the year, consumer charged up a storm in the second quarter, racking up $32.1 billion in new debt, according to CardHub, a credit card comparison site. CardHub says that’s the second highest quarterly total since it began keeping data on credit card debt in 2009.

While that buying binge could potentially signal improved confidence in the economy and in their own financial prospects, CardHub warns that the debt risks are building. It projects that consumers will close out the year with an annual net increase of more than $60 billion in credit card debt, with the total credit card debt outstanding climbing to more than $900 billion, the highest since the recession.

Related: 5 Cities with the Most Credit Card Debt

CardHub CEO Odysseas Papadimitriou says that jump brings Americans “perilously close to a tipping point at which balances become unsustainable and delinquency rates skyrocket.”

For 7 out of the past 10 quarters, consumers have racked up more debt than they’ve paid off. Papadimitriou cites that as evidence that consumers are going back to the bad habits they had before the economic downturn.

CardHub based its study on data from the Federal Reserve, and if the results are a sign of trouble then another new report from the Federal Reserve Bank of New York suggests that problem is even worse than it looks. In a report called “Do We Know What We Owe,” the New York Fed found that people widely underestimate their credit card debt, telling the Fed’s survey-takers that it’s about 37 percent lower than what lenders say it is.

So if we are actually getting to a tipping point with credit card debt, it may be even closer than we realize.

Top Reads From The Fiscal Times

- Millions Facing a Hefty Increase in Medicare Premiums in 2016

- How Much Does Our Social Safety Net Cost? $742 Billion a Year and Rising

- The 10 Worst States for Property Taxes

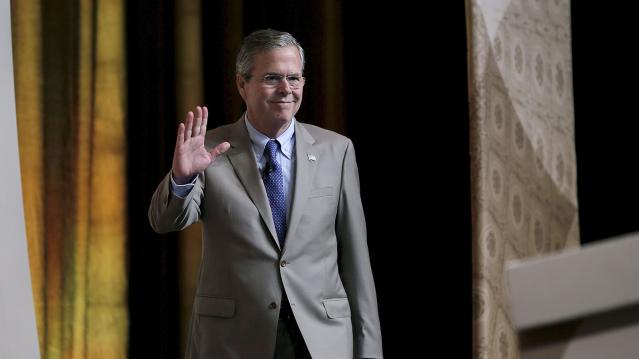

Watch Jeb Bush Do His Best Donald Trump Impression with Stephen Colbert

Unless you've been in your own personal media blackout for the last few days, you're probably aware that Stephen Colbert kicked off his new show Tuesday night and that Jeb Bush was one of his first guests. While the maiden voyage of the new “Late Show” has drawn mixed reviews -- “promising, if he relaxes” says USA Today, referring to the host – the show provided plenty of entertaining bits and compelling if somewhat odd moments.

Like much of the show, Colbert’s conversation with Bush was a mixed bag. Both host and guest seemed a bit nervous and some of their lines fell flat. Surprisingly, one of the more entertaining parts of their conversation never made it on air: Colbert had Bush read some text written in the bombastic voice of Donald Trump. Bush was game for the joke, and the results are worth a look.

The fun at Trump's expense starts at the 2:32 mark, when Stephen Colbert refers to the "big, orange elephant in the room."

Top Reads from The Fiscal Times:

- Fading Fast in New Hampshire, Bush Dips into War Chest

- The 2016 Presidential Primary Carnival Rages On

- There’s Only One Candidate People Actually Like – and It’s Not Trump or Clinton

Here’s Why Home Prices Are Climbing So Quickly

Want to buy a home but finding slim pickings? Blame the builders.

New home construction has not kept pace with the improving job market in recent years and is part of the reason that housing inventory is so scarce and home prices are growing so quickly, according to a report released today by the National Association of Realtors.

After over-building leading up to the housing bubble, developer laid off workers and scaled back construction by more than 75 percent. After the crash many of those workers migrated to other industries, making it harder for builders to quickly ramp up work. There are also fewer builders now than there were a decade ago, with many going bust in the bubble and others consolidating with competitors.

Related: How a Smart Home Can Save You Time and Money

While home starts have come back since the recession, the new NAR report finds that in two-thirds of markets homebuilding activity has not kept pace with the number of newly employed workers. In particular, construction of single-family homes remains at less than half its prerecession levels.

Many of the markets with the largest disparity of jobs versus home construction were hit hardest by the housing crisis but have fully rebounded, including San Jose, San Francisco, San Diego and Miami. New York is also among the top cities where home building has not kept pace.

There are several reasons that new home construction has grown so slowly in recent years, including rising construction and labor costs and tight credit. Despite those headwinds, new home construction is expected to grow by more than 25 percent this year.

Top Reads From The Fiscal Times:

- Can Anyone Stop the $38 Billion Airline Fee Squeeze?

- 7 Common Myths That Can Ruin Your Retirement

- The 25 Most Expensive Cities for Renters

Millennials to Employers: Show Us the Money

When it comes to company loyalty, money matters to millennials. Twenty-nine percent of millennials say that a higher salary is the biggest contributor to their loyalty, according to data released Tuesday by the Staples Advantage Workplace Index.

That compares to 20 percent of the overall workforce who place a priority on salary. The difference could be related to the fact that millennials tend to make lower wages than other workers and face higher fixed costs on things like student loans and rent.

Still, the job market is tightening, making it easier for millennials who feel they are underpaid to look elsewhere for work. The unemployment rate for millennials has fallen by nearly 40 percent since its peak in 2010.

Related: 18 Companies Americans Hate Dealing With the Most

Millennials are willing to work long hours but they want to be able to do so on their own terms. More than half of younger workers said that they work from home after the work day is over, compared to 39 percent of the all workers. Nearly half of millennials said that increased flexibility would improve their happiness.

Other important factors for millennials are office perks such as a gym or free lunches, having an eco-friendly office and a company culture that encourages breaks.

Whether or not they’re happy with their current roles, millennials are looking toward the future with ambition. Seventy percent of those surveyed said they expect to be in a management position in the next five years.

Top Reads from The Fiscal Times:

- Stocks Are Sending a Recession Warning

- The 10 Fastest-Growing Jobs Right Now

- Mark Cuban: The Lesson Investors Can Learn From China

Gas Prices at an 11-Year Low for Labor Day Weekend

Drivers will be paying less at the pump as we head into one of the largest travel weekends of the year. Gas prices over Labor Day weekend haven’t been this low since 2004.

The national average price of gas is currently $2.44 per gallon, 99 cents less than this time last year, according to AAA. The average consumer can expect to save $15 to $25 on each trip to the gas station.

Related: 6 Reasons Gas Prices Could Fall Below $2 A Gallon

AAA estimates that 35.5 million people are planning to travel this weekend, a 1 percent increase from last year. The majority of travelers, 30.4 million, are expected to drive to their destinations, a rise of 1.1 percent from last year.

Gasoline prices are moving lower thanks to the falling price of crude oil. Oil has been hit by worries over economic growth in emerging markets, Iranian oil flooding the market and crude oil inventories rising due to economic and weather factors, a U.S. Energy Information Administration report finds.

For drivers, there’s more good news ahead. AAA expects gas prices to keep falling, with gas selling for $2 or less a gallon by Christmas in many parts of the U.S.

Top Reads From The Fiscal Times

- The 10 Worst States for Property Taxes

- Obama to GOP: Don’t Kill the Economy This Fall

- Why China’s Slowdown Will Lead to Sustainable Growth