Feeling Flush, More Parents Open Their Wallets for College Spending

As lingering financial fears from the recession fade, more parents are willing and able to open their wallets to pay for their children’s educations.

Parents have become the top source of college funding for the first time since 2010. According to a new report from private student loan lender Sallie Mae’s, parental income and savings covered 32 percent of college costs in the academic year 2014-15, while scholarships and grants covered 30 percent.

Families spent an average of $24,164 on college this year, a 16 percent rise in spending from the previous year and the largest increase since 2009-10. The money spent covers costs of tuition, books, and living expenses.

Related: Average Family Has Saved Enough to Send One Kid to College for Half a Year

The report details how fewer parents fear the worst when it comes to the risks associated with college. Fewer parents are worried that their child won’t find a job after graduation, that their income will decline because of layoffs, and that there will be an increase in student loan rates. As confidence has increased, fewer families are using cost-saving techniques, such as having students live at home.

Another factor contributing to the willingness of parents to spend on education is the improving stock market. The average size of a 529 account, the popular college savings investment plan, continues to grow after the recession caused a downturn, hitting a balance of $20,474 as of December 1, 2014. That figure tumbled to $10,690 at the end of 2008, according to data from the College Savings Plan Network.

Although parents may be feeling better about paying for college, the basic trend of increasing prices continues, and loans are still a big part of the funding picture. Between 2001 and 2012, average undergraduate tuition almost doubled, causing an average real rate increase of 3.5 percent each year. Nearly 71 percent of college graduates left school with student loan debt this year, up from 54 percent 20 years prior. The average debt was $35,000 in 2015, an increase of 34 percent from 2010, student loan-tracker Edvisors has found.

You Won’t Believe How Much Diabetes is Costing the U.S.

The budget-busting price of Sovaldi, a drug used to treat hepatitis C has generated wave after wave of media attention, but it’s far from the only drug creating cost problems for patients and insurers.

As Michelle Andrews of Kaiser Health News points out, diabetes affects 29 million Americans, or 10 times as many people as hepatitis C, and the costs of treating it have been rising quickly. And because it’s a chronic condition, people require lifetime care.

Related: Diabetes Detection Up in Pro-Obamacare States

In 2011, the average annual health spending for individuals with diabetes was $14,093. Two years later, it had risen to $14,999, according to the Healthcare Cost Institute. In contrast, a person without diabetes spent about $10,000 less in medical costs in 2013. Pharmacy provider Express Scripts said earlier this year that 2014 marked the fourth year in a row that medication used to treat diabetes were the most expensive of any traditional drug class.

In all, diabetes costs totaled an estimated $245 billion in 2012, including both direct medical expenses and indirect costs from disability and lost work productivity.

While some of the most popular diabetes drugs aren’t particularly expensive, the new brand-name drugs that are continually being introduced offer more effective treatment and fewer side effects — but also come with a higher price tag. Less than half of the diabetes prescription treatments filled in 2014 were generic.

Nearly a century after its discovery in 1921, insulin is still a common form of treatment for the millions of people with type 1 diabetes, yet there is still no generic form available. Patent protection has been extended in some cases due to improvements in existing formulations. Once those patents expire, Andrews notes, biologically similar drugs could replace them and reduce the price by up to 40 percent.

Related: This Disease Hikes Health Care Costs By More than $10,000 a Year

The financial ramifications of diabetes don’t just stem from the cost of drugs or medical treatment — it’s also been proven that people with diabetes have a high-school dropout rate that is six percentage points higher than those without the disease, according to a Health Affairs study. In addition, young adults with diabetes are four to six percentage points less likely to attend college than those without the disease.

Diabetes also contributes to lower employment and wages. On average, a person with diabetes earns $160,000 less over the course of their lives than people who don’t develop the disease. By age 30, a person with diabetes is 10 percent less likely to be employed.

So even if it’s not generating as many headlines as hepatitis C at any given point in time, the costs of diabetes can’t be ignored.

Top Reads From The Fiscal Times

- The 10 Worst States for Property Taxes

- Two-Thirds of Americans Believe Social Security Is in a Crisis State

- Why McDonald’s Could Suddenly Be Responsible for Millions of New Employees

For Most Seniors, Social Security Is Their Biggest Source of Income

The 80-year-old Social Security program has long been known as the third rail of American politics -- touch it and you die.

Last year alone, more than 59 million Americans received retirement, disability and survivor’s benefits totaling $863 billion. While some lawmakers and policy experts warn that the system will begin to run short of cash beginning in 2035, seniors’ advocacy groups have vigorously fought major changes and cuts.

Related: Battle Lines Form in the Fight Over Social Security Payment Reductions

Some nine out of ten people who are 65 or older receive Social Security benefits, according to the Social Security Administration, with an average monthly benefit of $1,294 average for retirees. Overall, Social Security benefits constitute about 38 percent of the income of the elderly, but that number varies greatly from individual to individual.

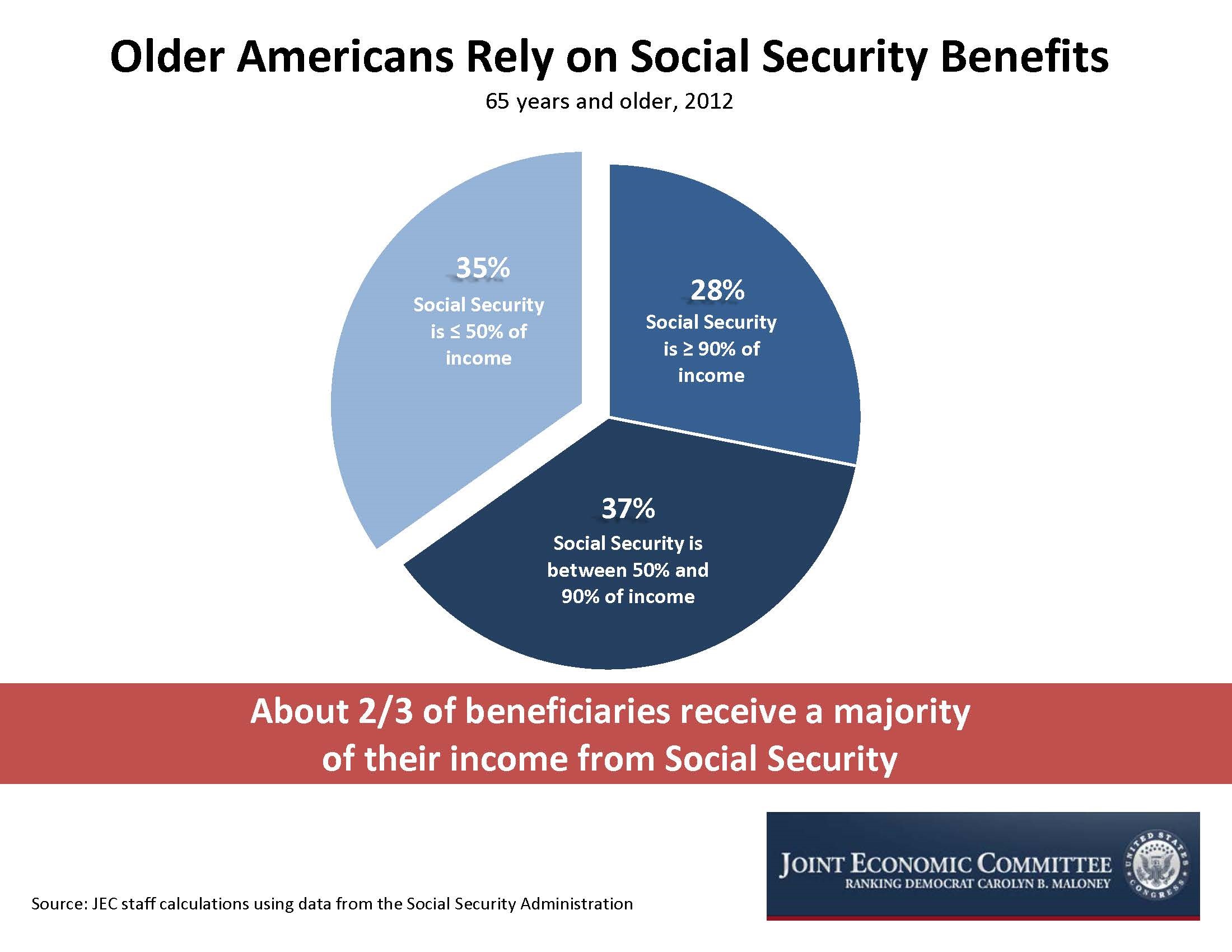

For the majority of seniors, Social Security makes up the majority of their income. Sixty-five percent of beneficiaries age 65 and older get more than half of their income from the program. Nearly a third (28%) rely on Social Security for 90 percent or more of their income.

Related: 4 Ways to Fix Social Security

The pie chart below, prepared by the staff of the congressional Joint Economic Committee, illustrates the range of seniors’ dependence on Social Security benefits:

Fund Managers Making Millions from University Endowments

The soaring endowments at America’s top universities are doing more to line the pockets of the millionaire private equity fund managers who run them than they are for the schools’ students, argues a New York Times op-ed published today.

At Yale University last year, for example, fund managers received $480 million in compensation for managing a third of Yale’s $24 billion endowment. Meanwhile, the school spent just $170 million of that endowment on tuition assistance, fellowships and prizes, according to an analysis by Victor Fleischer, a law professor at the University of San Diego.

He found a similar at Harvard, the University of Texas, Stanford and Princeton. “We’ve lost sight of the idea that students, not fund managers, should be the primary beneficiaries of a university’s endowment,” Fleischer writes. “The private-equity folks get cash; students take out loans.”

Related: Harvard’s In-House Fund Managers Get 70 Percent Pay Hike

It’s worth noting that all the schools Fleischer cites do have relatively generous tuition assistance programs, and they often spend their endowments on capital improvements and other projects that indirectly benefit students. Their endowments have also enjoyed record returns under private equity management.

Fleischer argues that college endowments should be required to spend a percentage of their assets each year, much like other private endowments. That would lead to lower overall endowments but might put a damper on tuition increases and would lead to improved research facilities, he claims.

Last year American universities invested about 11 percent of their portfolios in private equity and saw a 16.5 percent return on them, according to the National Association for College and University Business Officers.

Top Reads from the Fiscal Times:

- Replace Obamacare with What? GOP Candidates Start Slinging Proposals

- Clinton Tries to Brush Off Email Affair as She Wades Deeper into the Morass

- From Russia with Sub: Amazing Pictures of Putin in the Black Sea

John Kasich’s Latest Endorsement Could Be a Game-Changer

Ohio’s Republican Gov. John Kasich on Monday sought to enshrine his status as a top-tier presidential candidate when he rolled out the endorsement of Alabama Gov. Robert Bentley.

“John Kasich is a leader whose readiness to lead our nation on his first day in the Oval Office is unmatched,” Bentley said during a joint appearance at the Alabama Sports Hall of Fame. “America needs John Kasich, and I am going to do everything I can to help make sure he is our next president.”

Related: 10 Things You Need to Know About John Kasich

On paper, the Republican governor of a deep-red Southern state endorsing a GOP presidential candidate months before the first primary votes are cast may not come as much of a surprise, but it could ultimately mean a great deal for Kasich’s White House bid.

The Ohio Republican, with his compassionate conservative message, has touted himself as a moderate in the crowded GOP field; winning the support of the executive of one of the most conservative states in the nation could help him broaden his appeal in the party.

Alabama is set to play a major role in the GOP’s 2016 nomination process. The state is one of eight in the South that will hold a vote on March 1 in the so-called “SEC primary.”

Sen. Ted Cruz (R-TX), another White House hopeful, has called the cluster of states the “firewall” for his candidacy and wrapped up a southern bus tour last week, drawing large crowds in Tennessee, Mississippi and Arkansas.

Related: Did Kasich Just Do an About-Face on Climate Change?

By making hay of Bentley’s endorsement, Kasich also aims to stay in the spotlight and secure his place on the main stage when Republicans meet again next month for their second debate.

Kasich announced his candidacy just a few weeks before the first debate in Cleveland earlier this month in the hope that his initial splash in the polls would be enough for him to make the cut-off for the prime time event. The strategy paid off; Kasich received standing ovations and thunderous applause whenever he answered a question before the home state crowd.

But surveys taken since the debate show former Hewlett-Packard CEO Carly Fiorina surging in the polls, meaning another contender is likely to get bumped off stage.

After Bentley’s announcement, Kasich, who has bet his candidacy on winning the New Hampshire primary and watched his numbers steadily rise there, will make a campaign swing through the Granite State, Iowa and South Carolina.

Top Reads from The Fiscal Times

- Mark Cuban: Here’s Why Republicans Will Lose the Election

- Here Are 5 Democrats Who Could Scuttle the Iran Deal

- 9 Trump Positions that Make Liberals Want to Move to Canada

Here’s How Much It Would Cost the Military to Provide Transition Care to Transgender Troops

As the U.S. military studies the implications of lifting a ban on transgender people serving in the armed forces, a new study says that the cost of providing transition-related health care to those service members would be about $5.6 million a year, or “little more than a rounding error in the military's $47.8 billion annual health care budget.”

After U.S. Defense Secretary Ashton Carter announced in mid-July that that Department of Defense would look into lifting the ban, opponents expressed concern about the potential high costs of providing care to transgender individuals. In last week’s debate among Republican presidential candidates, former Arkansas Gov. Mike Huckabee said he wasn’t sure “how paying for transgender surgery for soldiers, sailors, airmen, Marines makes our country safer.”

Related: The Surprising Way the Military Could Save Millions

The new study published in The New England Journal of Medicine estimated that 12,800 transgender troops currently serve and are eligible for health care in the U.S., but only 188 transgender service members would require transition-related care annually. Aaron Belkin, the San Francisco State University researcher who conducted the survey, checked for accuracy using data from the Australian military, which already covers transition-related care, and compared costs with insurance plans offered to University of California employees and their dependents.

Belkin emphasized that costs could be lower than expected for several reasons. Among those, transition-related care would mitigate other serious and potentially costly conditions, such as suicidal thoughts, and might improve job performance.

Acknowledging that the costs might be higher than he estimates, Belkin still says they would be too low to matter and shouldn’t be a factor in deciding whether the ban is lifted or not.

In June, the American Medical Association said there is “no medically valid reason” to prohibit transgender individuals from serving in the military.

Top Reads From The Fiscal Times

- The Pentagon’s Next-Generation Budget Busting Bomber

- Mark Cuban: Here’s Why Republicans Will Lose the Election

- The $1 Trillion Question for the F-35: Is the U.S. Buying an Interior Plane?