The Most Expensive Cities for Singles -- and the Cheapest

Looking for love in all the pricey places? Check out these lists of the most and least expensive cities for singles before you go on that next date or plan your next move. Looking good doesn’t come cheap, and the price of a decent wardrobe and a gym membership add ups before you even step out the door.

To determine which cities were the least and most affordable for singles, GoBankingRates examined 89 cities and rated them according to four expense categories -- clothing, dates, gym memberships and rent -- using data from Numbeo.com. “Singles are more likely to exercise, and to have a gym membership,” says Elyssa Kirkham, a finance writer for GoBankingRates. “They’re more likely to rent than own a home, and spend more money on dates and clothing.”

Related: Hot New Dating Criteria: What’s Your Credit Score?

San Francisco is the most expensive city for singles, especially when it comes to rent. Rent is 30 percent more expensive in San Francisco than it is in Honolulu. The cost of a date here is $147, compared with the median cost of $109. California just might be the most expensive state to date in, claiming seven of the top 15 spots: San Francisco, Fremont, Glendale, Irvine, Los Angeles, San Diego and Oakland.

The second most expensive city? New York City, which boasts the most expensive gym membership at $90 per month. Clothing costs here are the second-highest in the nation -- bad news for all the Carrie Bradshaws out there. And date night will set you back $145.

The most expensive date night in the country is in Washington, D.C., which came in third overall. Date night in our nation’s capital costs $166 for dinner, a bottle of wine, two movie tickets and a 10-mile taxi ride. Compare that to Chattanooga, Tennessee, which had the cheapest date night at $78.

Looking for more bang for your buck? Move to Reno, Nevada. Rent here is just 86 cents per square foot, and a night out averages $97.30. Keep in mind, though, that “the Biggest Little City in the World” was once known as the divorce capital of the world, so dating there may offer less promise than other locales.

Related: The Bad News About All the Singles in America

Most Expensive Cities for Singles

- San Francisco

- New York

- Washington, D.C.

- Honolulu

- Boston

- Fremont, California

- Glendale, California

- Anchorage, Alaska

- Miami

- Seattle

- Irvine, California

- Los Angeles

- San Diego

- Oakland, California

- Madison, Wisconsin

Related: Marriage?? Young Americans Aren’t Even Shacking Up

15 Cheapest Cities for Singles

- Reno, Nevada

- Tucson, Arizona

- Grand Rapids, Michigan

- Tacoma, Washington

- Indianapolis

- Mesa, Arizona

- Little Rock, Arkansas

- Albuquerque, New Mexico

- Huntsville, Alabama

- Memphis, Tennessee

- St. Louis, Missouri

- Jackson, Mississippi

- Stockton, California

- Omaha, Nebraska

- Chattanooga, Tennessee

Dow Plunges into Correction Territory: Here’s How Bad Friday’s Market Bloodbath Was

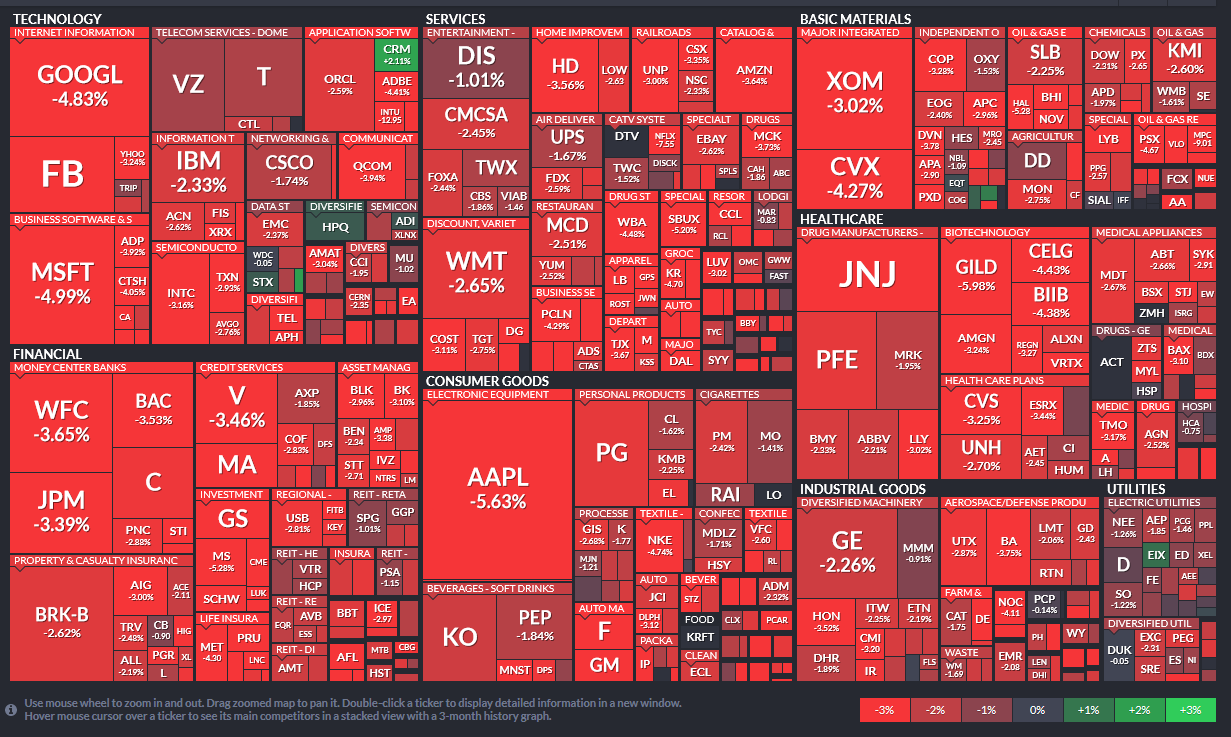

U.S. stocks closed sharply lower on Friday as slowing growth in China and worries about a possible rate hike by the Fed took their toll. The Dow Jones Industrial Average finished the day down 531 points for a 3.12 percent loss. The S&P lost 65 points (-3.16 percent) — its worst day since Aug. 8, 2011 — and the Nasdaq lost 171 (-3.52 percent). For the first time since 2011, the Dow is now in a correction, meaning it has lost 10 percent from its peak. The S&P is nearing correction territory, too, having lost 7.5 percent since its May 21 closing high.

Related: The Stock Market's Fed Fever Is Only Going to Get Worse

The selloff was widespread, with 491 of the S&P 500 stocks ending the day in the red and only 11 managing to advance (the S&P 500 actually includes 502 stocks). For the week, 487 of the S&P 500 stocks fell and only 15 gained. In total, the S&P 500 lost a collective $1.14 trillion in market value on the week. Yes, trillion with a "T."

This snapshot from finviz of the performance of stocks in the S&P 500 gives a sense of Friday's carnage (Click it to enlarge):

This Is America’s Favorite Credit Card

According to consumers, it does pay to Discover.

For the second year in a row, Discover has ranked the highest in customer satisfaction among credit card issuers, according to the results of a new survey by J.D. Power.

Discover received a score of 828 out of 1,000 in the survey, based on credit card terms, billing and payment, rewards, benefits and services, and problem resolution. American Express placed second with a score of 820, and Chase ranked third at 792.

Overall satisfaction with credit cards hit a record high of 790, up from 778 last year.

Related: 3 High-Tech Ideas to Fraud-Proof Our Credit Cards

Consumers were more likely to use their rewards last year, with more than half having done so in the past six months. That could be because rewards are getting better as banks get more creative with wooing and keeping customers, many of whom are still lukewarm about spending.

“When customers feel the rewards are attractive and when they redeem rewards more frequently, satisfaction improves, they spend more, and they are more likely to recommend the card to friends and family members,” Jim Miller, J.D. Power senior director of banking services, said in a statement.

Customers who redeem rewards spend an average of $1,128 per month, compared to $645 by those who don’t redeem rewards.

Even though they’re more satisfied with their credit cards, Americans are still concerned about ID theft. Less than a third of those surveyed felt their personal information was very secure, and just 16 percent thought that security had improved since last year.

Top Reads from the Fiscal Times:

- Trump: ‘I’ve Gained Such Respect for the People That Like Me’

- Why McDonald’s Could Suddenly Be Responsible for Millions of New Employees

- Americans Want Medicare to Negotiate Better Deals on Drugs

Long Hours at Work Are Costing You More Than Your Social Life

Putting in long hours at the office might impress your boss, but they’re certainly not helping your health.

A new study published in The Lancet found that individuals who worked 55 hours per week or more had a 1-3 times greater risk of a stroke compared to those who worked 40 hours a week. Long working hours were also associated with an increased chance of coronary heart disease, but this association was found to be weaker than that for a stroke.

The analysis was the largest study conducted thus far of the affiliation between working hours and cardiovascular health, including data on more than 600,000 individuals in Europe, the U.S., and Australia.

Researchers believe the constant triggering of the stress response from overwork induces the stroke, often resulting in sudden death. In addition, behavioral activities that stem from the longer hours also contribute to the heightened chance of a stroke.

Employees who work longer hours are found to rely more on heavy alcohol consumption as a way to reduce stress, but drinking only increases the risk for all types of strokes. In addition, more time at a desk means long periods of physical inactivity, which can increase the risk of stroke.

A study by Credit Loan shows that employees worldwide are working more than 40 hours per week. The U.S. leads the pack with the highest percentages of overtime workers – 85.8 percent of males and 66.5 percent of females.

Someone ought to tell Jeb Bush before he repeats what he said early in the campaign -- that Americans need to put in more hours at work.

Why Millennials Are Waiting So Long to Buy Their First Homes

They may finally be moving out of their parents’ basements, but don’t expect those boomerang kids to be taking out a mortgage any time soon.

Today’s first-time homebuyer rents for an average of six years before buying his or her first home, according to a new analysis by Zillow. Time spent renting has been marching mostly upward since the 1970s, when first-time buyers rented for just 2.6 years before purchasing a home.

Today’s first-time buyers are also more likely to be single and older (with an average age of 32.5) than previous generations.

“Millennials are delaying all kinds of major life decisions, like getting married and having kids, so it makes sense that they would also delay buying a home,” Zillow Chief Economist Svenja Gudell said in a statement.

Related: Found Your Dream Home? 7 Tips for Getting the Best Deal

Part of the reason for that delay could be that homes cost much more than they did decades ago. Today’s homebuyer makes roughly the same amount of money in inflation-adjusted terms as a buyer in the 1970s, but the homes that they’re purchasing are about 60 percent more expensive.

There are other roadblocks for first-timers. Limited inventory and strong competition make the home buying process difficult for property virgins and student debt can make it tougher to get a mortgage.

Those six years spent renting aren’t coming cheap, either. In 2013, almost half of all renters were spending more than 30 percent of their income on housing, with more than a quarter sending half their income to their landlord every month, according to the “State of the Nation’s Housing 2015” report issued in June by the Harvard Joint Center for Housing Studies. That makes it pretty tough to save for a down payment.

Top Reads from the Fiscal Times:

- Trump as Commander in Chief? Tune in for a Foreign Policy Reality Show

- Clinton’s Email Fail May Be Innocent, but Americans Still Don’t Trust Her

- As Obamacare Costs Rise, the GOP Has a Real Chance to Reform Health Care

Remember the Ice Bucket Challenge? It Actually Did Some Good

It turns out all those videos of people dumping buckets of ice water on their heads that clogged your newsfeed last summer helped scientists make a major breakthrough in ALS research. (ALS stands for amyotrophic lateral sclerosis, a neurodegenerative disease also known as Lou Gehrig’s disease.)

A new study published in the journal Science last week details a new understanding of an important protein – TDP-43 – that is dysfunctional in more than 90 percent of ALS cases. The Johns Hopkins scientists behind the research thanked the Ice Bucket Challenge for helping them with the discovery by raising $115 million in donations for the ALS Association.

Related: The 9 Most Amazing ALS Ice Bucket Challenges

“We want to encourage all of you to continue this Ice Bucket Challenge to really push this work forward,” professor Philip Wong said in a YouTube video.

More than 17 million videos were uploaded to Facebook of people pouring cold water on themselves, including celebrities like Taylor Swift, Oprah, and Bill Gates. The money raised through the challenge helped the ALS Association triple the amount it typically spends on research for the disease each year.

The ALS Association has been encouraging people to once again participate in the challenge this August, having introduced the hashtag #EveryAugustUntilACure. And it’s working – every Major League Baseball team has pledged to take the Ice Bucket Challenge some time this month.

Top Reads From The Fiscal Times

- Why McDonald’s Could Suddenly Be Responsible for Millions of New Employees

- Mark Cuban: Here’s Why Republicans Will Lose the Election

- 6 Reasons Gas Prices Could Fall Below $2 a Gallon