Blame China for Your Costly Lobster Roll

Looking for authentic, down-home Maine lobster? Head to China.

The upsurge in demand for lobster in China this year has caused the price of the succulent marine crustacean to shoot up to record highs in the U.S., according to Bloomberg News. Wholesale prices for lobsters have clawed 32 percent higher over the last year.

Lacking a lobster industry itself, China used to rely on Australian imports to meet the demand from an expanding middle class that views lobster as a status symbol. But in 2012, as catches off of Western Australia began dwindling and prices of lobster fell in the Gulf of Maine, China changed its main supplier to the U.S.

Related: McDonald’s Aims for a Classier Crowd with Lobster Rolls

Lobster exports from the East Coast are the main reason for the hike in fish and seafood exports to China in recent years, according to U.S. Department of Agriculture data. Over the past seven months, about 60,000 live North American lobsters a week make the 7,500-mile trek halfway across the world. The lobsters must still be alive by the time they arrive in China or else they lack appeal, so they’re packed in wet newspapers and Styrofoam coolers for a trip that must be made in 18 hours or less, according to Bloomberg.

Another reason for the surge in prices was the bitterly cold winter this year, which slowed the catch in Canada and delayed the summer harvest in Maine.

Holding off on your lobster roll until next summer in the hopes that prices will wane? Don’t count on it. The Chinese middle class is still growing rapidly, and the country already consumes 35 percent of the world’s seafood — a number likely to increase.

Top Reads from The Fiscal Times:

- Born in the USA: 24 Iconic American Foods

- America’s 10 Top Selling Medications

- You’re Richer Than You Think. Really.

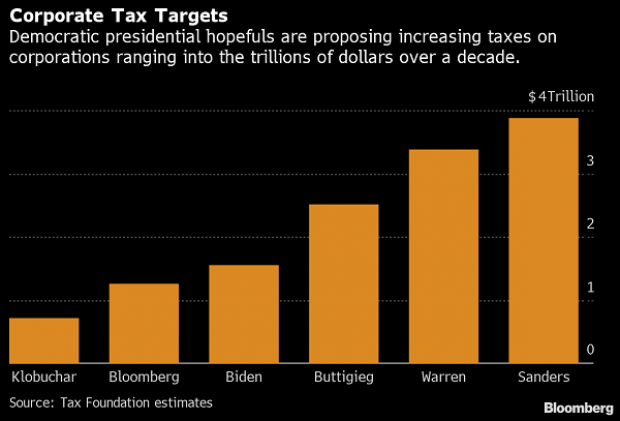

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

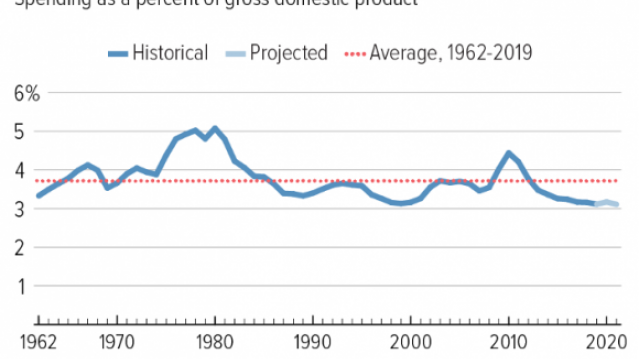

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

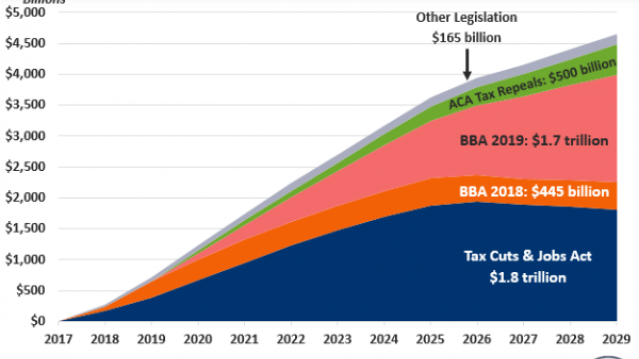

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

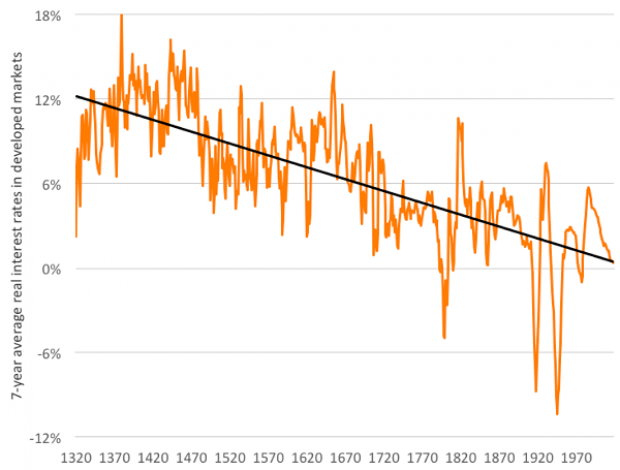

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

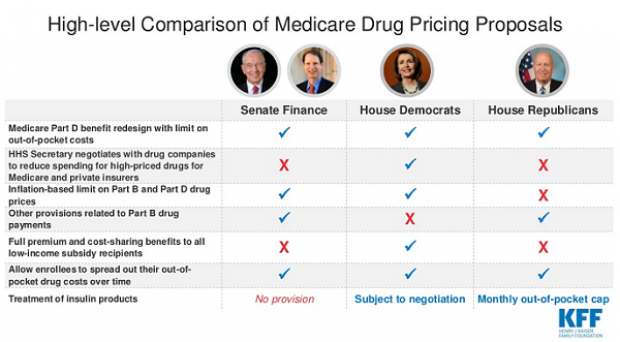

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.