Dow Sheds Nearly 600 Points, S&P 500 in Correction in a Wild Day on Wall Street

U.S. stocks plunged more than 3.5 percent on Monday, closing off session lows in high volume trade as fears of slowing growth in China pressured global markets.

S&P 500 ended nearly 80 points lower, off session lows of about 104 points lower but still in correction territory after the tech sector failed intraday attempts to post gains. Cumulative trade volume was 13.94 billion shares, the highest volume day since Aug. 10, 2011.

The major averages had a volatile day of trade, plunging sharply in the open and more than halving losses to trade less than 1 percent lower on the day, before closing down more than 3.5 percent.

"I think we probably rallied too fast. A lot of people that covered their shorts got their shorts covered," said Peter Coleman, head trader at Convergex. He noted the Dow was still trading several hundred points off session lows and that a close better than 500 points lower would be a good sign.

Related: The Stock Market's Fed Fever Is Only Going to Get Worse

"The market's going to be focused on China tonight to see if they come on tonight with something that would be considered a viable (way) to stimulate growth in that economy," said Quincy Krosby, market strategist at Prudential Financial.

The Dow Jones industrial average ended nearly 600 points lower after trading in wide range of between roughly 300 to 700 points lower in the minutes leading up to the close.

In the open, the index fell as much as 1,089 points, making Monday's move its biggest intraday swing in history. In midday trade, the index pared losses to trade about 110 points lower.

The blue-chip index posted its biggest 3-day point loss in history of 1,477.45 points.

During the first 90 minutes of trade, the index traveled more than 3,000 points in down and up moves.

"I'm hoping for some stability here but I think markets remain very, very vulnerable to bad news (out of) emerging markets," said Dan Veru, chief investment officer at Palisade Capital Management.

He attributed some of the sharp opening losses to exchange-traded funds. "It's so easy to move a bajillion dollars in a nanosecond."

Trading in stocks and exchange-traded funds was paused more than 1,200 times on Monday, Dow Jones said, citing exchanges. Such pauses total single digits on a normal day, the report said. An increase or decline of five percent or more triggers a five-minute pause in trading, Dow Jones said.

The major averages came sharply off lows in midday trade, with the Nasdaq off as low as less than half a percent after earlier falling 8.8 percent. Apple traded more than 1.5 percent lower after reversing losses to briefly jump more than 2 percent.

"There was sort of a lack of follow-through after the morning's crazy action in the overall market," said Robert Pavlik, chief market strategist at Boston Private Wealth. "The selling really dissipated once we got to around 10 o'clock."

He attributed some of the late morning gains to a short squeeze and bargain hunting.

Art Hogan, chief market strategist at Wunderlich Securities, noted that the sharp opening losses were due to great uncertainty among traders and the implementation of a rare market rule.

The New York Stock Exchange invoked Rule 48 for the Monday stock market open, Dow Jones reported.

The rule allows NYSE to open stocks without indications. "It was set up for situations like this," Hogan said. The rule was last used in the financial crisis.

Stock index futures for several major indices fell several percentage points before the open to hit limit down levels.

Circuit breakers for the S&P 500 will halt trade when the index decreases from its previous close by the following three levels: 7 percent, 13 percent, and 20 percent.

"Fear has taken over. The market topped out last week," said Adam Sarhan, CEO of Sarhan Capital. "We saw important technical levels break last week. Huge shift in investor psychology."

"The market is not falling on actual facets of a sub-prime situation. It's falling on fear of the unload of China. That's really behind this move," said Peter Cardillo, chief market economist at Rockwell Global Capital.

The CBOE Volatility Index (VIX), considered the best gauge of fear in the market, traded near 40. Earlier in the session the index leaped above 50 for the first time since February 2009.

"When the VIX is this high it means there's some panic out there," said Randy Frederick, managing director of trading and derivatives at Charles Schwab.

However, he said with stocks more than halving losses he "wouldn't be surprised if we closed positive." "If you could move it that far you could move it another 350 points" on the Dow," he said.

Overseas, European stocks plunged, with the STOXX Europe 600 down more than 5 percent, while the Shanghai Composite dropped 8.5 percent, its greatest one-day drop since 2007.

Treasury yields came off session lows, with the U.S. 10-year yield at 2.01 percent and the 2-year yield at 0.58 percent.

The U.S. dollar fell more than 1.5 percent against major world currencies, with the euro near $1.16 and the yen stronger at 119 yen versus the greenback.

A U.S. Treasury Department spokesperson said in a statement that "We do not comment on day-to-day market developments. As always, the Treasury Department is monitoring ongoing market developments and is in regular communication with its regulatory partners and market participants."

The Dow transports ended more than 3.5 percent lower to approach bear market territory.

About 10 stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 901 million and a composite volume of 4 billion as of 2:05 p.m.

Crude oil futures settled down $2.21, or 5.46 percent, at $38.24 a barrel, the lowest since February 2009. In intraday trade, crude oil futures for October delivery fell as much as $2.70 to $37.75 a barrel, a six-and-a-half-year low.

Gold futures settled down $6.10 at $1,153.60 an ounce.

This post originally appeared on CNBC. Read More at CNBC:

- Wharton's Siegel: We're going to test, possibly break this morning's lows

- Barclays: Fed unlikely to hike before March 2016

- One of Wall St's biggest bulls throws in the towel

Hillary Too Expensive? Get Chelsea Clinton at a Discount

If you’re turned off by the astronomical speaking fees commanded by the former Secretary of State and her former president husband, you have an option: You can go Clinton shopping.

Hillary and Bill Clinton earned in excess of $25 million for delivering 104 speeches between 2014 and the first three months of 2015, including $11 million that Hillary Clinton collected delivering 51 speeches, according to reports filed with the Federal Election Commission.

Related: Hillary Clinton’s Achilles' Heel: Trust

While Hillary’s fees varied, they typically exceeded a quarter-million-dollars a pop and went as high as $300,000, although she generally donated the funds to the Clinton family’s global foundation.

But at least one sticker-shocked university balked at her price and settled for a bargain basement alternative – daughter Chelsea Clinton.

As The Washington Post recounted on Tuesday, officials of the University of Missouri at Kansas City were in the market for a celebrity speaker to headline a gala luncheon marking the opening of a women’s hall of fame in early 2014. Initially, they thought of inviting Clinton’s 34-year old daughter to deliver brief remarks at the event.

When Chelsea’s speaking agency responded that she probably wouldn’t be available, university officials decided to “shoot for the moon” and invite her mother, the presumptive 2016 Democratic presidential candidate, to appear instead. However, they were stunned when the answer came back that Hillary Clinton indeed would be available but it would cost them $275,000.

Related: College Students Outraged over Hillary Clinton’s Massive Speaking Fees

University officials regrouped and resumed their hunt for a speaker. Then word came back that Chelsea Clinton was available to speak after all – and for the relatively modest fee of $65,000. Likely still reeling from the Hillary demand, university officials jumped at the offer.

Chelsea Clinton appeared at the luncheon on Feb. 24, 2014, and here’s what her schedule called for: a 10-minute speech followed by a 20-minute, moderated question-and-answer session and a half-hour posing for pictures with VIPs off-stage. As with Hillary Clinton’s paid speeches at universities, Chelsea Clinton directed her fee to the Bill, Hillary and Chelsea Clinton Foundation.

School officials said Chelsea’s appearance, which was covered by private donations, was well worth the money. Reactions to the story on social media were less positive, with anti-Clinton commentators having a field day mocking America’s one-time and perhaps future first family.

The Washington Post Closes a Window on Hackers and Big Government

The Washington Post is pushing back against government surveillance, hackers and other nosy folks trying to get a peek at you and your data.

Starting Tuesday it will begin to encrypt parts of its website to make it more difficult to track the reading habits of visitors. The encryption will apply to the Post’s homepage, stories on the site’s national security page and The Switch, its technology policy blog.

A display icon of a small lock in the web address bar will signal readers that pages are encrypted. In addition, the secure pages will start with the letters “https,” rather than the standard “http.”

The encryption also has the potential to make it tougher for governments to censor content. If censors are monitoring website traffic, they can see only the domain a person is visiting, not the specific page. A country would have to block the entire website if it wanted to block content.

The Post acknowledges that the additional security measures could make online advertising less attractive to companies. Advertisers might also be driven away by having to make sure their content is also secure, an extra step some companies might not be willing to take.

The Post is the first major news organization to introduce such security measures. Last fall, The New York Times published a blog post imploring websites to implement secure connections, but it has yet to follow through on its own challenge.

However, other smaller news sources, such as the Intercept and TechDirt, use https technology by default.

Encrypted traffic is becoming increasingly common for many sites, including online banking and web-based email services. Earlier this month, the Obama administration ordered all public federal websites to begin using https technology by the end of 2016.

The social media giant Facebook announced in early June that users could encrypt notifications sent from the website to a user’s personal email address, protecting potentially sensitive emails. Facebook – as well as hackers, spies and others -- will be denied access to the user’s private encryption key.

This move prevents hackers who have accessed a user’s email inbox from being able to understand emails from Facebook without knowing their private key. While a user’s activity on the actual site will not be encrypted, this announcement could be the first in a series of moves to protect Facebooks’ user privacy.

Apple and Google have also implemented more security measures for user privacy over the last year.

The Sweet Credit-Card Perk You Have But Don’t Know About

You know that your credit card offers rewards like cash back and airplane miles, but many cards also offer automatic travel insurance, which could prove valuable on your next trip.

Nearly 90 percent of reward credit cards offer accident insurance while you’re on vacation and 63 percent cover luggage if you use you card to pay for the trip, according to a new report by CardHub. On nearly a quarter of cards that offer travel accident insurance, coverage is more than $300,000.

Almost three-quarters of cards that cover luggage will pay you for lost bags, while nearly half cover delayed luggage.

Related: Credit Cards Can Be Your Best Friend—or Worst Enemy

The report found that the Chase Sapphire Preferred Rewards Card offered the best travel insurance, followed by Discover It, Wells Fargo Propel 365 and Citi Prestige.

Coverage amounts vary and restrictions apply, so check in with your issuer to get the details of what your card offers.

Travel insurance isn’t the only time credit cards come in handy for travel. Some cards also offer roadside assistance. If your car breaks down, runs out of gas, or you lock your keys inside most credit cards will send roadside assistance to help you out.

That perk, while convenient, isn’t free. The issuers usually charge you a discounted rate for the service and bill it directly to your credit card. Discover, for example, charges $70 per incidence but covers 24-hour towing, assistance and locksmith services.

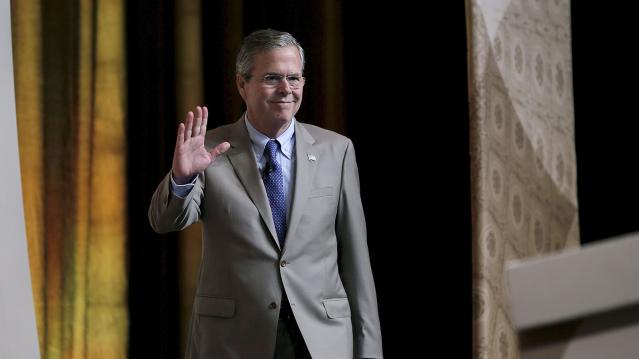

Jeb Bush Wasn’t Bashful About Trading on Family Name

While Jeb Bush frequently is touted as both a two-term governor and a successful businessman, his often dubious record as an entrepreneur and investor has been widely documented over the past three decades.

The 62-year-old scion of a powerful political family and now an announced candidate for the 2016 GOP presidential nomination was involved in a myriad business ventures dating back to the mid-1980s, The Washington Post noted on Monday in the latest media examination of Bush’s entrepreneurial exploits as he tried to amass his fortune.

Related: Jeb Bush Shows Some Fire in Campaign Launch

Bush brokered numerous real estate deals in Miami, helped to arrange bank loans in Venezuela, marketed shoes in Panama, sought out Mexican investors for a building-materials company, advised transnational financial services firms — you name it. He also made a boatload of money by sitting on a handful of corporate boards. And ever since he left the Florida governor’s office in 2007, Bush — like Democrat Hillary Clinton — has raked in substantial income by giving speeches while also consulting and managing investments for others.

“Jeb Bush had a successful career in commercial real estate and business before serving as Florida’s governor,” Kristy Campbell, a spokeswoman for Bush, told the Post. “He has always operated with the highest level of integrity throughout his business career.”

And yet the Post’s lengthy review of Bush’s business career — culled from records, lawsuits, interviews and newspapers accounts dating back more than 30 years — reveals a picture of a young man on the make who “often benefited from his family connections and repeatedly put himself in situations that raised questions about his judgement and exposed him to reputational risks.”

Related: Can Jeb Bush Unite the GOP’s Establishment and Religious Wings?

Five of Bush’s former business associates have been convicted of crimes; one remains an international fugitive on fraud charges. Bush has disavowed any knowledge of the wrongdoing and conceded that some of the businessmen he met in Florida took advantage of his relative youth and naiveté.

One thing that comes through loud and clear in the Post report is that Jeb Bush had no compunction about trading on his family name in trying to make a buck.

Major case in point: In early 1989, seven weeks after his father, George H.W. Bush, took office as president, Jeb Bush took a trip to Nigeria with the executive of a Florida company called Moving Water Industries. Bush had just been hired to help market the firm’s water pumps.

With no less than a special escort from the U.S. ambassador to Nigeria, Bush and his new boss met with the nation’s political and religious leaders as part of the company’s effort to land a deal that would be worth $80 million.

“My father is the president of the United States, duly elected by people that have an interest in improving ties everywhere,” the young Bush told the group. “The fact that you have done this today is something I will report back to him very quickly when I get back to the United States.”

Just days after Bush returned to the U.S., his father sent the president of Nigeria a handwritten note thanking him for hosting his son. Not surprisingly, Moving Water Industries eventually landed the deals it was seeking, according to the Post.

How to Save Greece? Try a Fundraiser

With Greece facing a loan payment of 1.6 billion euros to the International Monetary Fund on Tuesday, a man in London named Thom Feeney took it upon himself to launch a fundraising campaign for the financially strapped country on Indiegogo, an international crowdfunding site. As of late Monday afternoon, more than 400 people have pledged about 7,000 euros to the “Greek Bailout Fund,” and those numbers are climbing steadily.

Feeney says on Indiegogo that he is frustrated with European ministers and “all this dithering over Greece.” As Feeney states, “The European Union is home to 503 million people, if we all just chip in a few Euro then we can get Greece sorted and hopefully get them back on track soon. Easy."

He says he can clear the whole mess up with a contribution of just over three euros from each European. “That’s about the same as half a pint in London or everyone in the EU just having a Feta and Olive salad for lunch.”

Incentives for donors include a postcard with an image Alex Tsipras, the Greek Prime Minister, for a donation of three euros, and a Greek feta and olive salad for six euros. Ten euros gets you a small bottle of ouzo, and a pledge of 25 euros will earn you a bottle of Greek wine.

So far at least 90 donors will be expecting postcards, 35 can look forward to a salad, 40 have signed up to receive a bottle of ouzo, and 30 can expect a bottle of wine. But whether anyone will actually receive their rewards remains to be seen. Like the Greek creditors, the donors will have to wait and see if their payments ever arrive.

Update: As of Tuesday morning, more than 10,000 people have donated about 170,000 euros, and the numbers continue to rise. Feeney has stated that all the money will be returned if the fundraiser fails to reach its target.