Dow Sheds Nearly 600 Points, S&P 500 in Correction in a Wild Day on Wall Street

U.S. stocks plunged more than 3.5 percent on Monday, closing off session lows in high volume trade as fears of slowing growth in China pressured global markets.

S&P 500 ended nearly 80 points lower, off session lows of about 104 points lower but still in correction territory after the tech sector failed intraday attempts to post gains. Cumulative trade volume was 13.94 billion shares, the highest volume day since Aug. 10, 2011.

The major averages had a volatile day of trade, plunging sharply in the open and more than halving losses to trade less than 1 percent lower on the day, before closing down more than 3.5 percent.

"I think we probably rallied too fast. A lot of people that covered their shorts got their shorts covered," said Peter Coleman, head trader at Convergex. He noted the Dow was still trading several hundred points off session lows and that a close better than 500 points lower would be a good sign.

Related: The Stock Market's Fed Fever Is Only Going to Get Worse

"The market's going to be focused on China tonight to see if they come on tonight with something that would be considered a viable (way) to stimulate growth in that economy," said Quincy Krosby, market strategist at Prudential Financial.

The Dow Jones industrial average ended nearly 600 points lower after trading in wide range of between roughly 300 to 700 points lower in the minutes leading up to the close.

In the open, the index fell as much as 1,089 points, making Monday's move its biggest intraday swing in history. In midday trade, the index pared losses to trade about 110 points lower.

The blue-chip index posted its biggest 3-day point loss in history of 1,477.45 points.

During the first 90 minutes of trade, the index traveled more than 3,000 points in down and up moves.

"I'm hoping for some stability here but I think markets remain very, very vulnerable to bad news (out of) emerging markets," said Dan Veru, chief investment officer at Palisade Capital Management.

He attributed some of the sharp opening losses to exchange-traded funds. "It's so easy to move a bajillion dollars in a nanosecond."

Trading in stocks and exchange-traded funds was paused more than 1,200 times on Monday, Dow Jones said, citing exchanges. Such pauses total single digits on a normal day, the report said. An increase or decline of five percent or more triggers a five-minute pause in trading, Dow Jones said.

The major averages came sharply off lows in midday trade, with the Nasdaq off as low as less than half a percent after earlier falling 8.8 percent. Apple traded more than 1.5 percent lower after reversing losses to briefly jump more than 2 percent.

"There was sort of a lack of follow-through after the morning's crazy action in the overall market," said Robert Pavlik, chief market strategist at Boston Private Wealth. "The selling really dissipated once we got to around 10 o'clock."

He attributed some of the late morning gains to a short squeeze and bargain hunting.

Art Hogan, chief market strategist at Wunderlich Securities, noted that the sharp opening losses were due to great uncertainty among traders and the implementation of a rare market rule.

The New York Stock Exchange invoked Rule 48 for the Monday stock market open, Dow Jones reported.

The rule allows NYSE to open stocks without indications. "It was set up for situations like this," Hogan said. The rule was last used in the financial crisis.

Stock index futures for several major indices fell several percentage points before the open to hit limit down levels.

Circuit breakers for the S&P 500 will halt trade when the index decreases from its previous close by the following three levels: 7 percent, 13 percent, and 20 percent.

"Fear has taken over. The market topped out last week," said Adam Sarhan, CEO of Sarhan Capital. "We saw important technical levels break last week. Huge shift in investor psychology."

"The market is not falling on actual facets of a sub-prime situation. It's falling on fear of the unload of China. That's really behind this move," said Peter Cardillo, chief market economist at Rockwell Global Capital.

The CBOE Volatility Index (VIX), considered the best gauge of fear in the market, traded near 40. Earlier in the session the index leaped above 50 for the first time since February 2009.

"When the VIX is this high it means there's some panic out there," said Randy Frederick, managing director of trading and derivatives at Charles Schwab.

However, he said with stocks more than halving losses he "wouldn't be surprised if we closed positive." "If you could move it that far you could move it another 350 points" on the Dow," he said.

Overseas, European stocks plunged, with the STOXX Europe 600 down more than 5 percent, while the Shanghai Composite dropped 8.5 percent, its greatest one-day drop since 2007.

Treasury yields came off session lows, with the U.S. 10-year yield at 2.01 percent and the 2-year yield at 0.58 percent.

The U.S. dollar fell more than 1.5 percent against major world currencies, with the euro near $1.16 and the yen stronger at 119 yen versus the greenback.

A U.S. Treasury Department spokesperson said in a statement that "We do not comment on day-to-day market developments. As always, the Treasury Department is monitoring ongoing market developments and is in regular communication with its regulatory partners and market participants."

The Dow transports ended more than 3.5 percent lower to approach bear market territory.

About 10 stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 901 million and a composite volume of 4 billion as of 2:05 p.m.

Crude oil futures settled down $2.21, or 5.46 percent, at $38.24 a barrel, the lowest since February 2009. In intraday trade, crude oil futures for October delivery fell as much as $2.70 to $37.75 a barrel, a six-and-a-half-year low.

Gold futures settled down $6.10 at $1,153.60 an ounce.

This post originally appeared on CNBC. Read More at CNBC:

- Wharton's Siegel: We're going to test, possibly break this morning's lows

- Barclays: Fed unlikely to hike before March 2016

- One of Wall St's biggest bulls throws in the towel

How IBM Is Making Your Passwords Useless

For years, quantum computing has been hailed as a technology that could change the way the modern world works, but a long-standing technical issue has kept that potential from being realized. Now, in a paper published in the journal Nature last week, IBM scientists have taken a big step (see how I avoided the temptation to make a pun there?) toward solving that problem — and while it could represent progress toward making quatum computers real, it also could mean that current cybersecurity standards will soon be much easier to crack. In other words, your passwords could be obsolete soon.

The power of quantum computing has some obvious appeal: The increase in processing power could speed up research, especially in big data applications. Problems with large datasets, or those that need many millions (or billions, or more) of simulations to develop a working theory, would be able to be run at speeds unthinkable today. This could mean giant leaps forward in medical research, where enhanced simulations can be used to test cancer treatments or work on the development of new vaccines for ebola, HIV, malaria and the other diseases. High-level physics labs like CERN could use the extra power to increase our understanding of the way the universe at large works.

But the most immediate impact for the regular person would be in the way your private information is kept safe. Current encryption relies on massively large prime numbers to encode your sensitive information. Using combinations of large prime numbers means that anyone trying to crack such encryption needs to attempt to factor at least one of those numbers to get into encrypted data. When you buy something from, say, Amazon, the connection between your computer and Amazon is encrypted using that basic system (it's more complicated than that, but that's the rough summary). The time it would take a digital computer to calculate these factors is essentially past the heat death of the universe. (Still, this won't help you if your password is password, or monkey, or 123456. Please, people, use a password manager.)

Quantum computing, however, increases processing speed and the actual nature of the computation so significantly that it reduces that time to nearly nothing, making current encryption much less secure.

The IBM researcher that could make that happen is complicated, and it requires some background explanation. For starters, while a "traditional" computing bit can be either a 0 or a 1, a quantum computing bit can have three (or infinite, depending on how you want to interpret the concept) states. More specifically, a qubit can be 0, 1, or both.

Up until now, the both part of that caused some problems in realizing the power of quantum computing.

Up until now, the both part of that caused some problems in realizing the power of quantum computing.

Apparently — and you'll have to take this on faith a bit, as it hurts my head to think about it — the both state can switch back to either 0 or 1 at any given point, and sometimes incorrectly, based on the logic in the programming. Think about when your phone freezes up for a second or two while you're matching tiles. This is its processor handling vast amounts of information and filtering out the operations that fail for any number of reasons, from buggy code to malware to basic electrical noise. When there are only the two binary states, this is a process that usually happens behind the scenes and quickly.

The hold-up with quantum computing up until now is that the vastly greater potential for errors has stymied attempts to identify and nullify them. One additional wrinkle in this reading quantum states is familiar to anyone with basic science fiction knowledge, or perhaps just the ailurophobics. What if the action of reading the qubit actually causes it to collapse to 0 or 1?

The very smart people at IBM think they've solved this. The actual technical explanation is involved, and well beyond my ability to fully follow, but the gist is that instead of just having the qubits arrayed in a lattice on their own, they are arranged such that neighbors essentially check each other, producing the ability to check the common read problems.

That opens the door to further quantum computing developments, including ones that will make your password a thing of the past. So, does this mean that you need to start hoarding gold? No, not yet. And hopefully before quantum computing reaches commercial, or even simply industrial/governmental levels, a better cyber security method will be in place. Or the robots will have already taken over. I for one welcome them.

Medicare Overpaid $251 Million in 18 Months for Drugs

By reimbursing certain drug providers based on outdated pricing, Medicare has squandered millions of dollars that could have been saved if the recommendations of a government watchdog had been followed.

As reported by The Washington Examiner, the Office of the Inspector General for the Health and Human Services Dept. found that Medicare has continued to pay providers of infusion drugs, which are delivered through IV pumps, at higher prices than necessary. HHS is paying providers based on 2003 prices when the drugs were more expensive--this despite warnings from the IG, most recently in February, 2013.

“Medicare payment amounts for infusion drugs…substantially exceeded the estimated acquisition costs,” according to findings reported on the IG’s website.

The IG said that had its recommendations been implemented, $251 million would have been saved over an 18-month period.

The Centers for Medicare & Medicaid Services (CMS) apparently ignored the IG when it proposed that the agency push legislation that would have brought the method of reimbursement for infusion drugs in line with the process for other pharmaceuticals. As an alternative, the IG recommended that the CMS employ competitive bidding to supply infusion drugs.

“CMS partially concurred with the first recommendation, but has not taken steps toward seeking legislation,” The IG’s report said. “CMS concurred with the second recommendation but said subsequently that…infusion drugs will not be included in competitive bidding until at least 2017.”

So presumably the overpaying won’t stop anytime soon.

Why the Rich Tend to Cheat on Their Brokers

For affluent Americans, having more than one financial adviser has now become the norm.

One in three Americans with more than $100,000 in investable assets started a relationship with a new financial services firm last year, seeking to combine the strengths of various firms to gain advice and resources, according to a new study released Tuesday by Hearts & Wallets, a financial research platform for consumers.

Related: The 6 Times You Really Need a Financial Adviser

Hearts & Wallets also noted that 55 percent of consumers with $500,000 in investable assets or more work with three or more firms.

Contrary to the popular image of wealthy investors dialing up their Wall Street broker, the Hearts & Wallets survey found that affluent investors are more likely to use self-service firms — discount brokerages like E*Trade or TD Ameritrade — than full-service brokers. More than 70 percent of investors with $500,000 or more use those self-service brokers, even if it’s for smaller “play money” accounts, compared with 40 percent for full-service firms such as Ameriprise and Edward Jones.

“It’s astonishing the self-service competitive set has deeper reach into investors with $500,000-plus, engaging more affluent investors than the full-service competitive set,” said Laura Varas, Hearts & Wallets partner and co-founder, in a press release.

Related: 6 Traits of an Emerging Millionaire: Are You One?

Some wealthy investors use both. A common pattern is what Hearts & Wallets calls “stable two-timing,” or when investors balance a self-service firm with a full-service firm. Some consumers might even tap into multiple high-service firms to obtain different advice.

“Just as in retail stores, wealthy customers may trust and frequent a Bloomingdale’s, but they will still shop at Costco, too,” Varas said. “Smart consumers compare.”

Top Reads from The Fiscal Times:

- The 5 Worst Money Mistakes of Millionaires

- IRAs: Everything You Need to Know for 2015

- The Worst States For Retirement in 2015

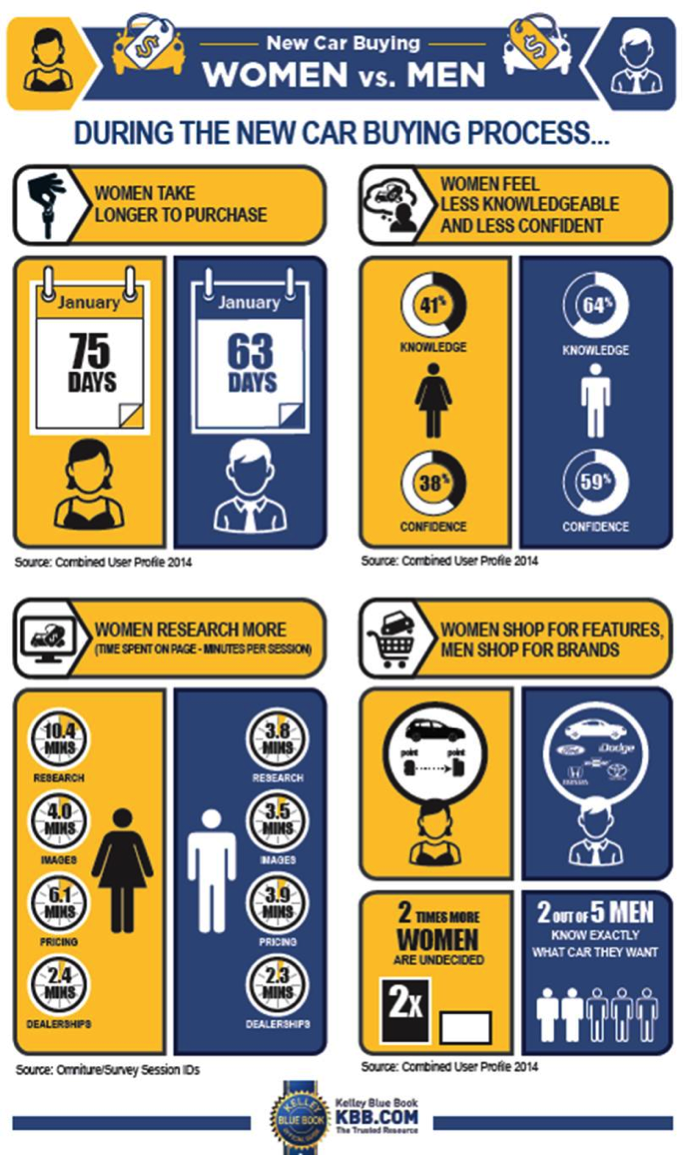

How Men and Women Differ When Buying New Cars

We all know men and women are different when it comes to money. Studies have found that women tend to be less self-assured and thus more considered and conservative in making financial decisions. That carries through to buying a new car, as the infographic below from Kelley Blue Book shows.

Recent surveys have found that Americans are increasingly skipping repeat visits to dealers’ lots — and in some cases even bypassing test drives — in favor of online research. Even so, the KBB study of about 40,000 U.S. adults found that women are more interested in features and safety while men are more likely to focus on styling and pursue a specific brand and model. KBB also found that, “while men are more likely to view their cars as tied to their image and accomplishments, women are more likely to see them simply as a way to get from point A to point B.” As a result, men want more trucks and luxury sedans while women are more likely to go for non-luxury Asian brands of SUVs and sedans.

Related: Car Sales Are on Pace to Do Something They Haven’t in 50 Years

Here are some other differences in how the car-buying process plays out:

Pentagon Doesn’t Know What Happened to $1.3 Billion in Afghanistan

The Pentagon isn’t able to tell federal auditors what happened to more than $1.3 billion in funds intended for construction projects in Afghanistan.

The money was dispersed through a program established to speed up the rebuilding process in Afghanistan by giving money directly to military officers to build roads, bridges, dams and other projects to avoid the lengthy bureaucratic procurement process.

But in the rush to spend and build, much of the money paid out by the Commander’s Emergency Response Program (CERP) between 2004 and 2014 has gone unaccounted for, according to auditors who spent the last year trying to find it.

Related: 7 Threats to U.S. Rebuilding Efforts in Afghanistan

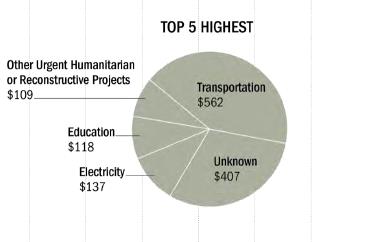

A new report released Friday by the Special Inspector General for Afghanistan Reconstruction says the Defense Department could only provide its office with documentation for $890 million, or roughly 40 percent, of the total $2.2 billion in funds.

The auditors blamed the Pentagon’s financial and project management process for not sufficiently tracking spending, saying DoD’s system doesn’t contain enough data or comprehensive information relating to the actual costs of the projects.

The auditors took the information the Pentagon did provide and divided it up into categories like education, health care, water and sanitation. Aside from transportation, the item that had the most expenses was labeled “unknown.”

U.S. Central Command responded to the inspector general’s findings, or lack thereof, by saying that some of the unaccounted for CERP funds had been shifted to other military needs. “Although the report is technically accurate, it did not discuss the counterinsurgency strategies in relationship to CERP,” the Central Command said.

In total, the U.S. has doled out about $3.7 billion through CERP funds, with $2.2 billion coming from the Defense Department.

This is just the latest report from SIGAR highlighting the Pentagon’s problems keeping track of the enormous amount of money flowing into Afghanistan. Earlier reporting suggested the U.S. has lost some $100 billion in the reconstruction efforts.