The 10 Worst States to Have a Baby

The birth rate in the U.S. is finally seeing an uptick after falling during the recession. Births tend to fall during hard economic times because having a baby and raising a child are expensive propositions.

Costs are not the same everywhere, though. Some states are better than others for family budgets, and health care quality varies widely from place to place.

A new report from WalletHub looks at the cost of delivering a baby in the 50 states and the District of Columbia, as well as overall health care quality and the general “baby-friendliness” of each state – a mix of variables including average birth weights, pollution levels and the availability of child care.

Mississippi ranks as the worst state to have a baby, despite having the lowest average infant-care costs in the nation. Unfortunately, the Magnolia State also has the highest rate of infant deaths and one of lowest numbers of pediatricians per capita.

Related: Which States Have the Most Unwanted Babies?

On the other end of the scale, Vermont ranks as the best state for having a baby. Vermont has both the highest number of pediatricians and the highest number of child centers per capita. But before packing your bags, it’s worth considering the frigid winters in the Green Mountain State and the amount of money you’ll need to spend on winter clothing and heat.

Here are the 10 worst and 10 best states for having a baby:

Top 10 Worst States to Have a Baby

1. Mississippi

- Budget Rank: 18

- Health Care Rank: 51

- Baby Friendly Environment Rank: 29

2. Pennsylvania

- Budget Rank: 37

- Health Care Rank: 36

- Baby Friendly Environment Rank: 51

3. West Virginia

- Budget Rank: 13

- Health Care Rank: 48

- Baby Friendly Environment Rank: 50

4. South Carolina

- Budget Rank: 22

- Health Care Rank: 43

- Baby Friendly Environment Rank: 49

5. Nevada

- Budget Rank: 39

- Health Care Rank: 35

- Baby Friendly Environment Rank: 46

6. New York

- Budget Rank: 46

- Health Care Rank: 12

- Baby Friendly Environment Rank: 47

7. Louisiana

- Budget Rank: 8

- Health Care Rank: 50

- Baby Friendly Environment Rank: 26

8. Georgia

- Budget Rank: 6

- Health Care Rank: 46

- Baby Friendly Environment Rank: 43

9. Alabama

- Budget Rank: 3

- Health Care Rank: 47

- Baby Friendly Environment Rank: 44

10. Arkansas

- Budget Rank: 12

- Health Care Rank: 49

- Baby Friendly Environment Rank: 37

Top 10 Best States to Have a Baby

1. Vermont

- Budget Ranks: 17

- Health Care Rank: 1

- Baby Friendly Environment Rank: 5

2. North Dakota

- Budget Rank: 10

- Health Care Rank: 14

- Baby Friendly Environment Rank: 10

3. Oregon

- Budget Rank: 38

- Health Care Rank: 2

- Baby Friendly Environment Rank: 14

4. Hawaii

- Budget Rank: 31

- Health Care Rank: 25

- Baby Friendly Environment Rank: 1

5. Minnesota

- Budget Rank: 32

- Health Care Rank: 5

- Baby Friendly Environment Rank: 12

6. Kentucky

- Budget Rank: 1

- Health Care Rank: 33

- Baby Friendly Environment Rank: 20

7. Maine

- Budget Rank: 25

- Health Care Rank: 10

- Baby Friendly Environment Rank: 15

8. Wyoming

- Budget Rank: 22

- Health Care Rank: 17

- Baby Friendly Environment Rank: 7

9. Iowa

- Budget Rank: 14

- Health Care Rank: 25

- Baby Friendly Environment Rank: 9

10. Alaska

- Budget Rank: 50

- Health Care Rank: 6

- Baby Friendly Environment Rank: 2

Top Reads From The Fiscal Times

- The 10 Worst States for Property Taxes

- Americans Are About to Get a Nice Fat Pay Raise

- You’re Richer Than You Think. Really.

One Woman Gets Revenge on Unrelenting Telemarketers

We all hate telemarketers, just as much as we hate cable companies. Put them together and it’s a lethal combination. One woman got her revenge from both yesterday when a judge ordered Time Warner Cable to pay her $229,500 after the company harassed her with 153 computer-controlled “robocalls.”

Even after Texas resident Araceli King requested and then demanded that the company stop contacting her, she received 74 more calls from Time Warner in less than a year. The company was actually leaving messages for Luiz Perez, an individual who once had her same phone number. But even after she explained her identity to a company representative the calls kept coming and King filed the lawsuit. The calls began in the summer of 2013 and King filed her lawsuit in March 2014.

Related: 18 Companies Americans Hate Dealing with Most

U.S. District Judge Alvin Hellerstein ruled that Time Warner Cable violated the Telephone Consumer Protection Act of 1991, which stipulates that consumers can sue for $500 for every unwanted call received. The judge tripled the penalty to $1,500 in this case because of the enormous number of calls.

Time Warner Cable countered that since the company believed it was calling Perez, who had consented to the calls, it was not responsible to King under the Act.

According to a telemarketer, before the National Do Not Call Registry came into effect in 2004 as an amendment to the Act, more than 137 annual calls were directed – on average -- at a single individual.

And as we all know, they usually came at dinner time or early on a Saturday morning when all you wanted to do was sleep.

One Woman’s $229,000 Revenge on Unrelenting Telemarketers

We all loathe telemarketers, probably even more than we hate cable companies. Put them together, though, and you reach a whole new level of consumer fustration. But one woman got a little bit of vindication from both entities when a judge on Wednesday ordered Time Warner Cable to pay $229,500 after the company harassed her with 153 computer-controlled “robocalls.”

Even after Texas resident Araceli King requested that the company stop contacting her, she received 74 more calls from Time Warner Cable in less than a year. The company was leaving messages for Luiz Perez, an individual who once had her same phone number, even after she explained her identity to a company representative and filed the lawsuit. The calls began in the summer of 2013 and King filed her lawsuit in March 2014.

Time Warner Cable countered that since the company believed it was calling Perez, who had consented to the calls, it was not responsible to King under the Telephone Consumer Protection Act of 1991, which stipulates that consumers can sue for $500 for every unwanted call received.

U.S. District Judge Alvin Hellerstein ruled that Time Warner Cable violated the Act. The judge tripled the penalty to $1,500 in this case because of the enormous number of calls.

The Hole Truth: Celebrating a Huge Day in Doughnut History

Whether you’re a Dunkin’ devotee or are crazy for Krispy Kremes, July 9 is a date you should celebrate.

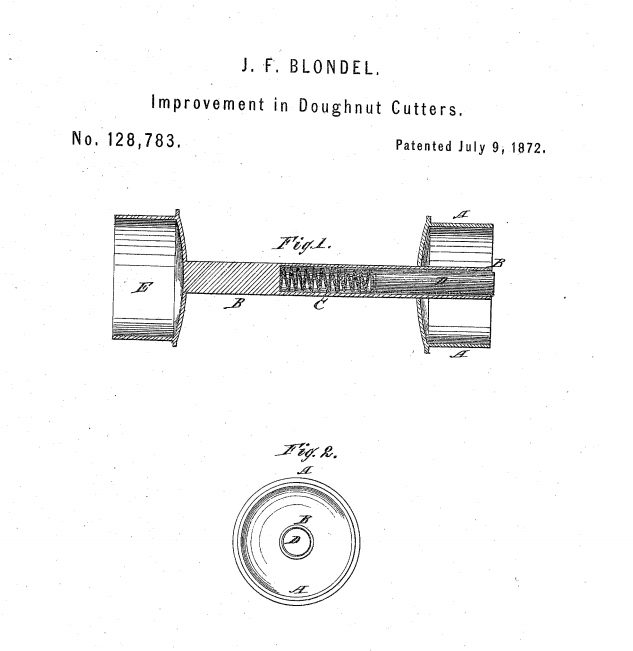

On that date back in 1872, the doughnut took a big step toward becoming the billion-dollar business it is today: John F. Blondel of Thomaston, Maine received a patent for a “new and useful” improvement in doughnut-cutters that would speed the production and consumption of the humble pastry in the United States.

The device described in Patent No. 128,783 was intended to automate the process of cutting those dastardly doughnuts — holes and all — as efficiently as a hole punch. The desired edge could be plain or scalloped. This ingenious contraption would push the dough out of the center tube, leaving it free for making the next doughnut.

Related: Made in the USA: 24 Iconic American Foods

But as Art Cashin — the director of floor operations for UBS Financial Services who regularly sprinkles historical tidbits into his commentary — pointed out in a note Wednesday, before you can talk about Blondel’s doughnut innovation, you have to know the story of one Hanson Crockett Gregory, the young genius who forever changed what you and I get when we order our plain, glazed or chocolate with sprinkles. While the history of the doughnut is disputed, Gregory claimed to have invented “the first doughnut hole ever seen by mortal eyes” as a 16-year-old sailor on a lime-trading ship and then taught the technique to his mother, Elizabeth Gregory.

In case you’re still hungry for more doughnut history, this Friday, July 10, Krispy Kreme is celebrating its 78th birthday by offering a sticky sweet deal at participating locations: Buy any dozen doughnuts at regular price and get a second dozen for 78 cents.

Oh, and if you want to purchase those pesky doughnut holes that get unceremoniously shoved from the middle? You can buy those, too. They’re simply called Doughnut Holes, and they can be bought by cup or box in assorted flavors of Original Glazed, Dipped Chocolate, Powdered, Chocolate Cake, Blueberry Cake and Plain Glazed Cake.

Hanson Crockett Gregory would no doubt be amazed.

Are Internet Ads Gender Biased?

In the most-watched soccer game in U.S. history, the U.S. trounced Japan in a 5-2 victory in the Women’s World Cup final. The U.S. team will receive $2 million from FIFA for the win. Last year, the German men’s team, which won the World Cup, collected a cool $35 million.

While FIFA is notorious for sexism among other dubious behaviors, a Carnegie Mellon University study confirms that other companies are also biased about women—especially when it comes to money. One troubling example: female job seekers on Google were less likely to be shown ads for high paying jobs than male job seekers.

Using an automated tool called AdFisher, researchers explored how Google’s automated ad server reacted when users with identical profiles--except for their gender--interacted with Google’s ads. The technology found that males were shown ads for a career coaching service for “$200k+” executive positions 1852 times, but the female group was shown those highly paid positions a mere 318 times. While the premier career coaching service ads were the top ads shown to males, the top ads shown to females were a regular job posting service and an auto dealer.

Google allows its advertisers to target a particular audience, so any company is allowed to promote different ads based on gender. In addition, the survey wasn’t able to pinpoint the source of the discrimination, whether it was Google, the advertiser, both of them, or the algorithm that was tracking the user behavior. Regardless of the cause, the research proves the inherent perils of customization and targeted ads.

The study was released just before a wave of criticism hit the tech industry, which was accused of gender bias in hiring practices. In general, at major companies like Facebook, Yahoo and Google, women hold few leadership posts and make up around 30 percent of employees.

To be fair, women have not exactly flocked to get degrees in computer science and related math and science areas. Those are the jobs tech companies value most since all new digital products require coding skills.

Two-Thirds of Parents Are Making This Big Financial Mistake

More than a third of Americans with young children don’t have any life insurance, and another third have policies with payouts of less than $100,000, according to a new analysis by Bankrate.com

The survey found that 42 percent of all Americans haven’t purchased life insurance, and about half of those with insurance have policies worth $100,000 or less, including 25 percent of those with a household income over $75,000.

Of course not everyone needs life insurance, but people who have family members depending on them financially should have a policy. The amount you need varies, depending on your future financial obligations, outstanding debts, and current assets.

Related: How to Calculate Your Life Insurance in 3 Easy Steps

Part of the reason for inadequate coverage could be that people underestimate the benefits they’re receiving from work (which don’t roll over from job to job), or they’re failing to update their policy after major life changes like the birth of a child or the purchase of a home.

Another factor: They’re misinformed about the price of life insurance. Eight in 10 consumers have incorrect ideas about the price of life insurance, with millennials overestimating the cost by 213 percent and Gen Xers overestimating it by 119 percent, according insurer trade organization LIMRA.

In addition to your age and health, the price of life insurance could be impacted by your credit history, driving record, and lifestyle.

The LIMRA study found that 30 percent of Americans think they need more life insurance, but more than half said it was unlikely that they’d purchase a policy in the next year.