Opposition to a $700 million plan to renew several expired tax breaks and make them permanent stirred enough anger among budget-conscious lawmakers and outside groups to persuade Congress to back away from the idea. Now a replacement proposal that would extend the breaks for two years is running into fire as well.

The tax breaks -- known as “extenders” because of lawmakers’ habit of extending them every year or two rather than allowing them to expire or making them permanent -- have become the focus of regular fights between champions of special interests on Capitol Hill and those concerned about the growth of the federal debt.

Related: 14 Outrageous Tax Deductions the IRS Denied

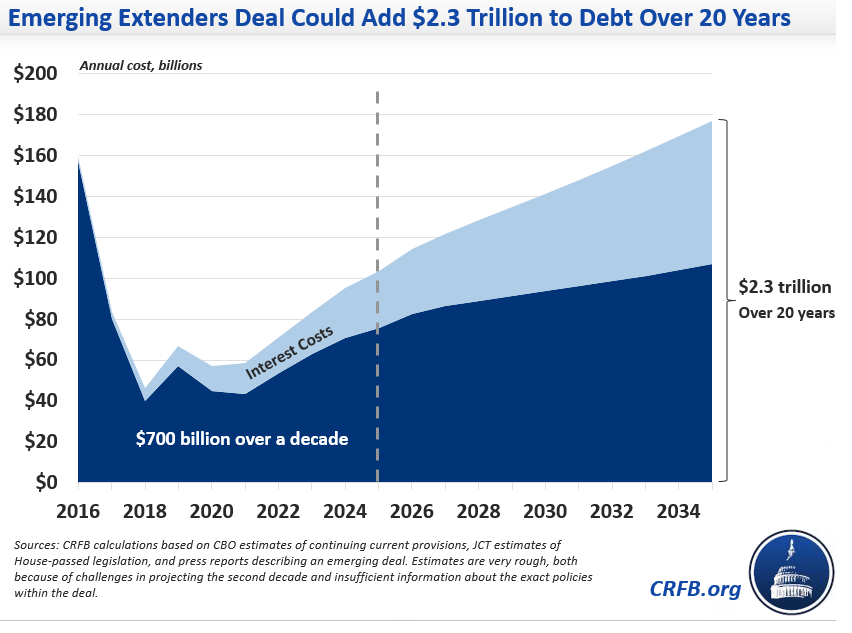

A proposal last month to make a number of the tax breaks permanent, including the research and experimentation tax credit beloved in the business community, ran into trouble when it became clear that the entire $700 million cost, plus an estimated $150 million in interest, would be added to the national debt.

However, while it may have a lower price tag, the replacement proposal, which would extend many of the breaks for two years – also without paying for them – is in some ways even more generous to its beneficiaries.

According to the Center for a Responsible Federal Budget, “the legislation introduced in the House, despite its lower price tag, would still be fiscally irresponsible – not only because it would add to the debt without offsets but because it would actually expand a number of tax breaks beyond their traditional cost.

“The expansions include making the research credit more generous – increasing its costs by 40 percent – increasing and expanding bonus depreciation, and indexing thresholds for Section 179 expensing, among others. The expansion of bonus depreciation moves in the opposite direction of the big deal being discussed which would phase out bonus depreciation over five years. The bill also includes a few new policies, such as legislation expanding 529 accounts considered earlier this year.”

The latest plan for the extenders package was to bundle it together with the massive omnibus appropriations bill that Congress has to muscle through in order to fund the government for the rest of the fiscal year.

Related: Lawmakers Press to Strike a Fatal Blow to the ‘Cadillac Tax’ on Healthcare Plans

However, the omnibus is expected to need Democratic support to clear the fractious House of Representatives, and on Friday, Minority Leader Nancy Pelosi (D-CA) said that if the extenders package gets attached to it, that help won’t be forthcoming.

“I don’t see very much support on the Democratic side for the tax extender bill,” Pelosi said. “It includes hundreds of billions of dollars in permanent tax breaks for special interests and big corporations while neglecting hard-working families.”

The one thing that looks certain about the extenders package right now is the uncertainty of its fate, as next week shapes up to be one filled with particularly complex legislative maneuvering.