Economists and market watchers looking for clarity on interest rates will likely be disappointed. Many had hoped the combination of the January jobs report and Fed Chair Janet Yellen’s semi-annual appearance before Congress next week would provide some hints about the central bank’s intentions, but the numbers released Friday morning by the Bureau of Labor Statistics were a mixed bag.

The total jobs created, 151,000, came in considerably lower than expected, and the previous month’s eye-popping 292,000 was revised down to 262,000. However, the report also found wages on the rise, more people entering (or re-entering) the labor force, and a decline in the unemployment rate from 5.0 percent to 4.9 percent – the lowest in eight years.

Related: Are Congress and the Fed Repeating the Mistakes of the Depression?

Economists say they don’t have high hopes for any major revelations from Yellen next week. Paul Ashworth of Capital Economics predicted the her appearance will be “only slightly more enlightening than Martin Shkreli’s testimony.” (Shkreli, the reviled former CEO of Turing Pharmaceuticals, repeatedly invoked his Fifth Amendment right to avoid self-incrimination in an appearance before a House panel Thursday.)

The U.S. economics team at BNP Paribas called the report “surprisingly positive,” and noted that, among other things, the increase in the labor participation rate, which brought more prospective workers back into the labor force, actually prevented the nominal unemployment rate from falling even further, to 4.8 percent.

At UBS, economist Samuel Coffin pointed out that the weaker jobs number appeared to be limited to two sectors of the economy.

“The slowing did not appear to reflect weather but more generally appeared to reflect unsustainable swings in a few isolated areas,” he wrote. “A swing in educational services subtracted 49k; a swing in employment services subtracted 63k; together, those two fully accounted for the slowing in payrolls.”

Related: The Unemployment System can’t Handle Another Recession

However, some economists, particularly on the liberal side of the policy spectrum, argued that the details of the report show an economy that is still in recovery mode and that needs to be nursed along by a continued application of low interest rates by the Federal Open Market Committee, lest gains be lost again.

“The sharp slowing in job growth was to be expected, given the slow growth reported in the economy,” wrote Dean Baker, co-director of the Center for Economic and Policy Research. “The labor market is still not tight enough to produce healthy wage growth. With many downside risks to growth, 2016 may not be a good year for workers.”

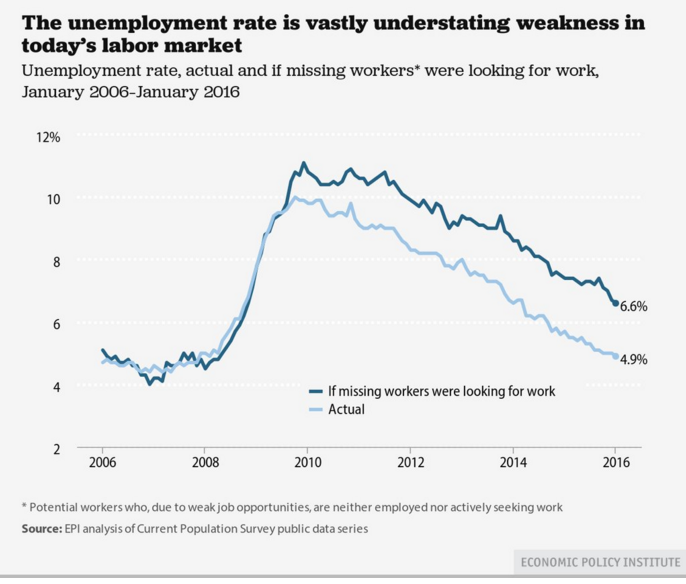

“Wage growth of 2.5 percent is far from any reasonable target given the Federal Reserve’s target inflation and trend productivity,” wrote Elise Gould, senior economist at the Economic Policy Institute.

“To keep moving us towards the goal of full employment — an economy where there is high demand for labor, and workers have more bargaining power to negotiate higher wages and get the hours they want — we need to keep our foot off the brakes and consider tapping on the gas. If the Federal Reserve hits the brakes by raising interest rates prematurely, the economy may never fully recover.”

Related: The Glaring Problem with Obama’s $10-a-Barrel Tax on Oil

Gould also updated her helpful chart reminding readers of just how many millions of Americans left the labor force prematurely during the Great Recession and its aftermath, and showing where the unemployment rate would be if they had all remained in the workforce.