The Fiscal Times Newsletter - August 28, 2017

|

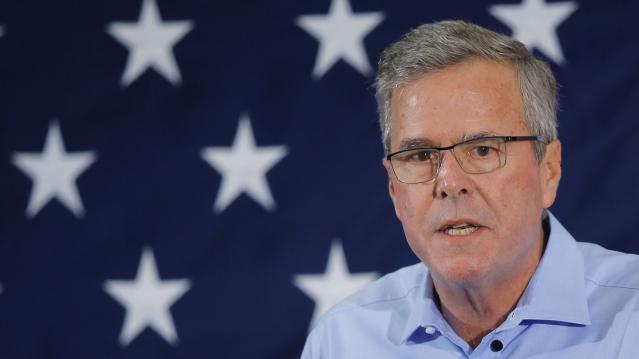

Jeb Bush Fires Back at Trump, but Is Anyone Listening?

Despite the sizzling Summer of Trump, Jeb Bush and the rest of the Republican establishment still don’t get it.

Bush just released an 80-second video entitled “The Real Donald Trump”, as flagged by Mike Allen in his Politico Playbook note this morning, in a slick effort to attack Trump by using his own words against him. That’s a classic campaign tactic, of course, and the effort by the Bush campaign is aimed at painting the bombastic real estate mogul from New York as a fake conservative – someone whose core values and views are anathema to Republicans in Iowa, where the Real Clear Politics poll average puts Trump in the lead for the GOP Caucuses with 21.3 percent.

Related: Two New Polls Show Exactly Why Donald Trump Is Winning

Here’s a sampling from the video:

Talking to Tim Russert on Meet the Press, 1999:

- “I’ve lived in New York City and Manhattan all my life, so you know my views are a little bit different than if I lived in Iowa.”

- “I am very pro-choice. I am pro-choice in every respect.”

From a 1999 Fox News clip:

- “As far as single-payer [heathcare system], it works in Canada. It works incredibly well in Scotland.”

Talking to Wolf Blitzer on CNN:

- Who would you like representing the United States in a deal with Iran? “I think Hillary would do a good job.”

- Do you identify more as a Democrat or a Republican? “Well, you’d be shocked if I said that in many cases I probably identify more as a Democrat.”

From a 2001 Fox News clip:

- “Hillary Clinton is a terrific woman. I’m a little biased because I’ve known her for years.”

Some of the clips are 15 years old or older and show Trump for what he was: a New Yorker with unremarkable New York liberal/centrist positions on a lot of issues.

Related: Fiorina PAC: CNN and GOP Are Conspiring Against Carly

The big question for Bush and other Republican politicians in the race is: Does it matter that much where Trump once stood or even where he now stands? If it doesn’t, that is going to make taking him down even more difficult.

What Trump is selling is unvarnished authenticity to an electorate tired of politicians who try to be all things to all people. You’re not going to catch Trump courting the gun crowd by saying he likes to hunt small varmints, like the patrician Mitt Romney did. Or donning a Rocky the Squirrel hat and riding around in a tank like Mike Dukakis did in 1988 to try to show he could be a credible commander-in-chief.

Mad-as-hell voters are sick of phoniness and goofy photo ops. When will the career politicians get that?

The 5 Worst States for Drivers

Folks in California and Washington might want to consider installing extra security devices on their cars. Bankrate says that California ranks as the worst state in the nation for car theft, with Washington not far behind. California has 431 car thefts per 100,000 people, while Washington has 407. The national average is 220.

Theft isn’t the only problem facing car owners. Bankrate also looked at data for other factors including fatal crashes, average commute times, gasoline and repair costs and insurance premiums to create a comprehensive ranking of the best and worst state for drivers.

Louisiana was named the worst state for drivers overall, mainly because of its above-average rate of fatal crashes. The Bayou State has 1.5 fatal crashes per 100 miles driven, while the national average is 1.1. Not surprisingly, it has the highest car insurance costs in the country. The state’s five-year average for a car insurance premium is $1,279, almost $300 more than the national average of $910.

Related: The Amazingly Stupid Things Smartphone Users Do While Driving

Thanks to its low gas and insurance costs, below-average theft and short commute times, Idaho ranks as the best state for drivers overall. Annual gas costs come to $733, more than $200 below the national average. Car insurance costs are typically around $656 and car thefts occur at a rate of 95 per 100,000 people. The average commute time for individuals each way is 19.5 minutes, nearly five minutes below the national average.

Here are the five best and the worst states for drivers:

5 Worst States for Drivers

1. Louisiana

2. California

3. Texas

4. Maryland

5. New Jersey

5 Best States for Drivers

1. Idaho

2. Vermont

3. Wyoming

4. Wisconsin

5. Minnesota

Top Reads From The Fiscal Times

- The 10 Safest Countries to Visit

- 6 Reasons Gas Prices Could Fall Below $2 a Gallon

- The 5 Worst Cities to Raise A Family

Google Tackles One of the Most Annoying Problems on the Internet

We’ve all been there: You’re surfing the Web and all of a sudden voices start coming out of nowhere. Quickly, you scramble to figure out which browser tab the autoplay media is coming from, and click around wildly trying to silence the offending intrusion.

If only there were some way to prevent such sonic irritations. According to Google, now there is.

Finally recognizing the problem of background audio from a video or ad that starts playing in a tab you’re not using, Google Chrome is now offering a solution. While Chrome already provided an icon that told you which tab was playing the audio, new versions of the browser let you mute the tabs with one click. And it gets even better.

Related: If You’re Reading This, Your Browser Could Be Hacked

Chrome will no longer automatically play media from backgrounded tabs unless you actually visit the tab. Not only does this feature reduce the annoyance of unwanted sound and trying to figure out where it’s coming from, but according to Google it will also conserve power. Chrome will consume less of your battery by playing only the videos and ads in the visible tab.

Take a (silent) bow, Google. You’ve earned it.

Top Reads From The Fiscal Times

- Air Force Brushes Off $27 Billion Accounting Error

- The 10 Worst States for Property Taxes

- If Clinton Loses Her Security Clearance, Could She Still Be President?

Facebook Hit a Mind-Boggling Milestone This Week

You know what’s cooler than having hundreds of millions of people use your product every day? Having a billion people use it in one day.

That’s what happened for Facebook for the first time on Monday when more than a billion people logged on to the social network, according to a post on CEO Mark Zuckerberg’s page. That’s one in seven people worldwide.

That means that a billion people potentially saw the ads that help generate the revenue that has powered Facebook’s growth. In particular, Facebook has been at the forefront of the shift toward earning ad dollars via online video, the fastest-growing digital advertising category.

Related: Will Facebook Kill the News Media or Save It?

Zuckerberg didn’t mention revenue in his post. Instead, he wrote that he is proud of the community built by the social network and said that connecting the world is making it a better place. “It brings stronger relationships with those you love, a stronger economy with more opportunities, and a stronger society that reflects all of our values.”

The milestone comes as the social network has been moving aggressively to monitor user habits and expand its product offerings to include instant messaging, photo-sharing and now a new virtual assistant. It has also explored moving into the e-wallet space and is reportedly looking into developing a credit rating system based on a user’s network.

While a billion users a day is nothing to scoff at, the company—as always—is dreaming bigger. Last month, Facebook finished construction of a drone that it hopes will provide Internet access to remote parts of the world. That way everyone everywhere can be wished a “Happy Birthday” by 300 people they haven’t spoken to in years.

How the Stock Market’s Wild Swings Have Helped Homebuyers

The rollercoaster week on Wall Street could pay off nicely for some homebuyers.

The sharp selloff in global markets, caused by the economic uncertainty in China, caused investors running for safety to buy up U.S. government bonds, driving interest rates down. That sent the rate on benchmark 30-year fixed-rate mortgages down to its lowest level since May.

Related: The Financial Mistake That Can Cost Homeowners

Mortgage giant Freddie Mac said Thursday that the average for 30-year fixed-rate loans fell to 3.84 percent, with an average 0.6 points, over the week ending August 27. That’s down from 3.93 percent last week and 4.10 percent a year ago. For 15-year fixed-rate loans, the average was 3.06 percent, down from 3.15 percent last week and 3.25 percent a year ago.

The average on 30-year fixed-rate mortgages has now been below 4 percent for five straight weeks. Just how long they stay there will be determined in part by when the Federal Reserve decides to raise interest rates for the first time since 2006. Many economists had expected the Fed to raise rates next month — but that was before the stock market’s latest shakeup.

"There are indications, though, that the unsettled state of global markets will make the Fed think twice before taking any action on short-term interest rates in September,” Sean Becketti, Freddie Mac’s chief economist, said in a statement. “If that's the case, the 30-year mortgage rate may remain subdued in the short-to-medium term, providing support for continued strength in the housing sector."

Related: Rate-Hike Havoc: Can the Fed Ignore This Market Rout?

Greg McBride, chief financial analyst with Bankrate.com, said mortgage rates may trend a bit higher from here as financial markets settle down, but he added that the Fed’s hike, whenever it comes, isn’t going to dramatically affect mortgage rates that are still historically low.

“That the initial move by the Fed is to a large extent already reflected in mortgage rates,” McBride said. “You might see a little bit of a further bump, but not much. Mortgage rates are not going to skyrocket. That’s the main point. Increases that we see in mortgage rates in the coming months are likely to be very limited."

Top Reads From The Fiscal Times

- The Troubling Truth Revealed by the Stock Market’s Nosedive

- Mark Cuban: The Lesson Investors Can Learn From China

- Why China’s Slowdown Will Lead to Sustainable Growth