The U.S. dollar is in the midst of an epic surge. The trusty greenback — which was famously derided by the likes of rapper Jay-Z and supermodel Gisele Bündchen just a few years ago — is up more than 25 percent from its early 2014 low.

Further gains look likely, too. Deutsche Bank is looking for the dollar to gain another 19 percent against the euro by 2017. All this is thanks to the combination of the relative health of the American economy and divergences in monetary policy stances.

Related: Why the Fed’s Patience Is About to Run Out

On the surface, this has been good news for American consumers enjoying a surge in real income (due primarily to lower energy and import prices). But there are downsides to a stronger dollar as well.

Stocks were pummeled Tuesday as investors begin to realize this, pushing the S&P 500 back below its 50-day moving average for the first time since January. The catalyst driving that action is the growing likelihood that the Federal Reserve responds to a fast tightening job market by raising interest rates for the first time since 2006 as soon as June. Compare that to the start of a new bond-buying stimulus by the European Central Bank and the ongoing desperation of the Bank of Japan.

Commodity prices in particular have been hammered, with the Deutsche Bank Commodities Tracking Fund (DBC) down more than 35 percent from the high hit last summer. And that, in turn, is plaguing emerging market economies, which are hurt by lower raw export revenue and exposure to China's economic slowdown. The iShares Emerging Markets ETF (EEM) is down nearly 15 percent from its September high and is down 6 percent since late February.

Related: Americans Are About to Get a Nice Fat Pay Raise

The chart below from Yardeni Research shows the close correlation between the value of the dollar and the value of emerging market stocks. What's scary is that the dollar's current valuation suggests a return to the 2008 financial panic lows could be in order — which would represent a 50 percent wipeout from here.

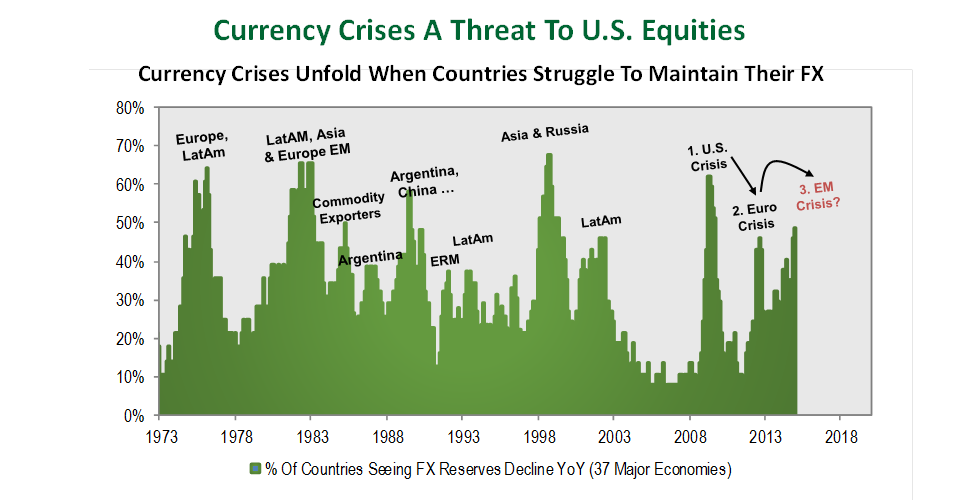

Cornerstone Macro’s analysts note that while a stronger dollar will pay dividends for the long beleaguered American consumer — setting the stage for a surge of income growth and balance sheet repair that hasn't been seen since the Clinton administration — it's greatly increasing the risk that a currency crisis rips through the emerging market economies. That's because the rise of the dollar has forced foreign central banks to tap into their foreign exchange reserves as their balance of trade declines. The longer this goes on, the more likely it becomes that currencies of the weaker countries will buckle under the pressure, resulting in a surge of inflation, punishing interest rates and economic turmoil. The S&P 500, like a bloodhound on the scent, has picked up on this risk and has begun to trade over the last few weeks in lockstep with a basket of emerging market currencies.

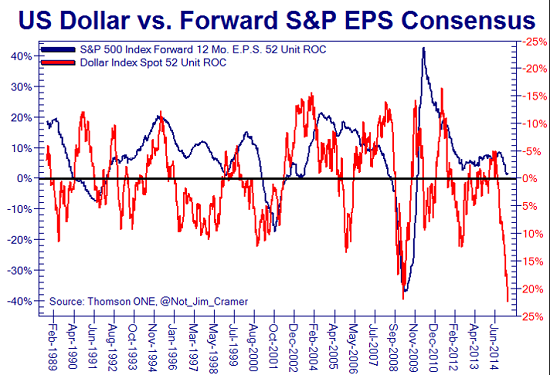

There's more at risk, too. A stronger dollar, weaker commodity prices (especially oil) and turbulence overseas all threaten the value of foreign profits earned by U.S. corporations at a time when earnings growth is already dropping at a pace that's associated with recessions. In fact, the last time the dollar strengthened to this extent was in the midst of the last two recessions.

The chart above shows how forward S&P 500 earnings estimates have tended to track the big changes in the dollar's valuation (which is on an inverse scale on the right side). When the dollar surged, earnings dropped.

Related: Why Stocks Are So Spooked by Great Job Gains

If all this wasn't enough, strategist George Saravelos at Deutsche Bank is concerned that the advent of negative interest rates in the bond yields of core Eurozone countries like Germany — and the launch of the ECB's bond buying program — will result in a massive capital outflow from the continent. The total outflow could be worth as much as 4 trillion euros.

In this environment, much of the money could pour into the U.S. in search of safety, further boosting the dollar and increasing the magnitude of the dynamics in play.

It's a policy quagmire. The U.S. has long espoused a strong dollar policy, but now doubts are beginning to grow. On Tuesday, Jason Furman, chairman of President Obama's Council of Economic Advisors, admitted that the dollar's strength is a headwind for the U.S. economy going forward. On Wednesday, the Chief Operating Officer of Goldman Sachs, Gary Cohn, said the rising dollar puts the Fed in a tough spot as the negative impacts of the rising currency are just starting to be felt.

Investors might be in a tough spot as well. The next shock could come on March 18 if the Fed, as expected, drops the "patience" language from its policy statement, putting a June rate hike in play.

Top Reads from The Fiscal Times: