By falling below the 18,000 and the 2,100 levels respectively on Friday, both the Dow Jones Industrial Average and the S&P 500 sank under thresholds that were first touched back in December. More than that, a better-than-expected headline reading on producer price inflation, along with a strong retail sales report earlier in the week and a solid May payroll report, increased the odds of a hawkish takeaway from the Federal Reserve this Wednesday.

Wall Street analysts are also talking up the risk of a surprise interest rate hike, which would end the 0 percent interest rate policy in place since 2008 and mark the first policy tightening since 2006. The market has been surprised and displeased by the Fed before, including its “taper tantrum” in response to former Fed Chairman Ben Bernanke's warnings of the impending end of quantitative easing in 2013.

As economists at IHS Global Insight noted, this will be the first policy meeting in nine years in which the Federal Open Market Committee members will actively consider raising interest rates. A surprise June rate hike isn't entirely off the table, but is seen as highly unlikely, with a September liftoff more widely expected.

Related: Fed Could Delay Interest Rate Hike As Bonds Sell Off

Standard Chartered economist Thomas Costerg believes the Fed's internal debate will hinge on two issues. The first is whether the economic weakness suffered in the first quarter, including private consumption, signals underlying fragility that has been underestimated. Many have blamed the weather for the slump, but there is a nagging concern that maybe something else is bothering consumers who have largely socked away their savings from cheaper gas prices.

The second issue is whether the U.S. economy's medium-term growth prospects have been lowered. We may be closer to full capacity than previously believed — a notion hinted at by evidence of structural frictions in the labor market, as job openings rise but hiring stalls (suggestive of a mismatch between jobs and workers). If that’s the case, higher inflation could materialize sooner than currently anticipated.

Economist Michael Hanson at Bank of America Merrill Lynch told clients in a research note Friday that the updated "dot plot" of Fed interest rates expectations should still pencil in two rate hikes this year and four in 2016, indicating rate moves in September and again in December.

The team at Societe Generale disagrees. She is looking for the dot plot to be downwardly revised — as it was in March, spurring a market rally — this time to show only one rate hike this year and four next year.

Related: Bond Market Is Sending the Fed an Important Signal

If that happens, it will likely be driven by a revision of the Fed's full-year 2015 GDP growth estimate to a range of 2.0 percent to 2.2 percent, down from 2.3 percent to 2.7 percent at the March meeting. Markowska expects Fed Chair Janet Yellen to express cautious optimism on the labor market in her post-announcement press conference but also frustration at an ongoing lack of wage inflation and the unevenness of economic growth.

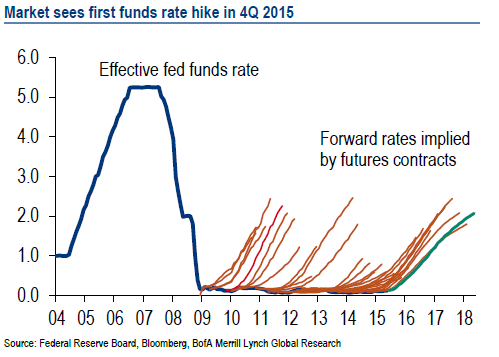

Still, the potential remains for a negative market response. The Fed's dot plot reflects a much more aggressive path for interest rates than futures traders are pricing in, as shown in the chart above. That suggests the assumption that the Fed's cheap money stimulus will go on and on is misplaced, setting the stage for disappointment.

Related: IMF’s Surprising Message to Yellen About Interest Rates

I can't say I blame folks for believing the Fed is too hawkish and optimistic in its expectations. The futures market has been fooled over and over again during this recovery on the likelihood of Fed rate liftoff. You can see that in the chart below. In each of the last seven years, higher interest rates appeared to be just over the horizon. And each time, some new problem appeared that stalled economic progress, spooked markets and undermined job gains.

Will rate hikes actually happen this time? With the unemployment rate at 5.5 percent, job openings at record highs and inflation stabilizing, it looks like they just might, soon if not this month. We may get a better sense of when on Wednesday.

Top Reads from The Fiscal Times: