Stocks closed out last week with their best one-day gain since October on the heels of a November non-farm payroll report that came in slightly better than expected.

To be fair, though, stocks have blasted higher on payroll Fridays regardless of the result: They did it back in September (big miss) and October (huge beat). And Friday's gains stood in stark contrast to the weakness seen on Thursday. Again, this follows a pattern: Pre-jobs report stock market weakness was seen in September and October.

The predictability points to computer trading algorithms playing games with everyone.

I point that out because the fears that have kept the Dow below the psychologically important 18,000 level remain in play, including worries over the consequences of a likely Federal Reserve interest rate hike on Dec. 16, made all the more probable by Friday's solid employment report.

Related: Why Raising Interest Rates Isn’t as Easy as It Sounds

Remember, the stock price weakness seen on Wednesday and Thursday was driven, in large part, by Fed Chair Janet Yellen’s comments about how job market gains were increasing her confidence that the annual inflation rate would soon return to the Fed's 2 percent target. She added that even tepid monthly payroll gains of less than 100,000 would be enough to keep the recovery on track. We got much more than that last month: November non-farm payrolls grew by 211,000 positions, slightly ahead of the 190,000 Wall Street was expecting. The unemployment rate held steady at 5.0 percent.

But maybe we should simply take Friday's job gains and stock market rally at face value: Investors are happy to see the economy shrugging off a myriad of headwinds —a recent slowdown in U.S. factory and services sector activity, terrorist attacks, weakness in crude oil and high-yield bonds — to keep putting more and more people to work.

If so, then the bulls will need to maintain the upward momentum heading into the Fed's rate hike announcement, which economists at BNP Paribas said was now "all systems go." And that means finally pushing the Dow Jones Industrial Average back over the 18,000 level that hasn't been crossed since July.

Otherwise, this looks like Wall Street shenanigans ahead of coming post-rate hike weakness.

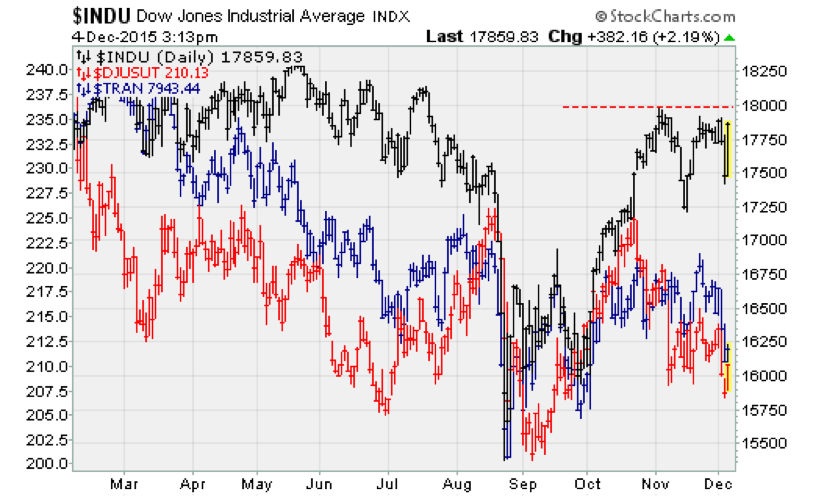

Consider the chart above, comparing strength in the Dow Jones Industrial Average to weakness in transportation stocks (blue line) and utilities (red line). Transport stocks are being hit by the biggest slowdown in manufacturing activity since early 2009, while utilities are being hit by the upward drift in long-term interest rates.

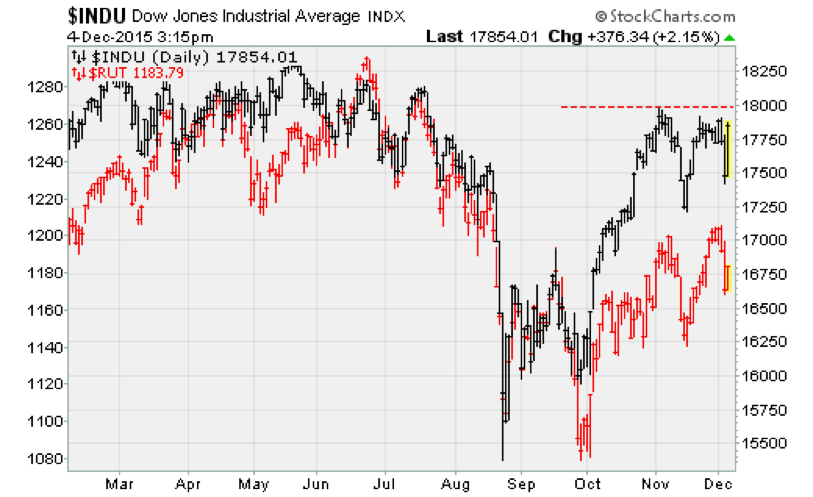

Or consider the chart above of the Dow vs. the Russell 2000 small-cap index (red line). This illustrates that the rebounds out of the October low and Friday's post-jobs enthusiasms are being driven by an increasingly narrow group of mega-cap tech stocks such as Microsoft (MSFT). Other, smaller stocks with more sensitivity to the ebbs and flow of economic growth and corporate profitability are being shunned.

In fact, the percentage of S&P 500 stocks in uptrends actually fell on Friday to 66.4 percent. This is down from a high of 72.2 percent in early November.

Finally, consider the chart below comparing the strength in the Dow to weakness in high-yield corporate bonds (red line) and commodity prices (blue line).

A decision by OPEC on Friday to leave production unchanged — in a continuance of its strategy meant to recapture market share from U.S. shale oil producers — will keep the pressure on energy prices, which in turn, will keep the pressure on overall corporate profits, due to the drag from energy producers like Exxon Mobil (XOM) and Chevron (CVX).

Related: Have We Seen the Top of the Bull Market?

The drop in junk bonds reflects an acknowledgement by bond traders that the credit cycle is turning, default rates are set to rise and deeply indebted U.S. shale oil producers will be increasingly squeezed in the months to come.

Sure, steady job gains are great. Yet it's hard to see stocks shrugging off all the other factors once the holiday cheer is over.