4 Ways to Fix Social Security

Social Security celebrates its 80th birthday today, and the popular program that provides paychecks for 44 million elderly Americans is in need of a safety net of its own.

As the amount claimed by recipients continues to outpace the amount of money contributed by workers, the system will need to dip into its reserves to keep up with its obligations by 2020. Within 15 years after that (if nothing changes), those reserves will be gone and the system will only be able to pay 77 cents on every dollar owed, an amount that will continue to decrease with time.

The problem is even more acute given that future retirees won’t have the same access to pensions that many current retirees use to fund their retirement, and younger workers haven’t saved nearly enough to cover the costs they’ll face when they stop working.

To close the projected gap, the country needs to raise revenue, reduce benefits or some combination of the two. Here are four of the most commonly proposed solutions:

1. Raise the retirement age. For most Americans, the full retirement age (at which you can get full benefits) ranges from 65 through 67. Advocates of this solution would reduce the amount the government pays in Social Security by gradually pushing back the age at which you’re eligible for full benefits.

The drawback: Many Americans are already forced into retirement before they reach age 65. If they claim early and receive reduced benefits they may not have enough money to meet their basic needs. Also, workers in physically demanding jobs many not be able to work those extra years.

2. Raise the payroll cap. Social Security is funded via payroll taxes, which currently are only levied on the first $118,500 of income. That means that high earners effectively pay a much lower rate toward Social Security than others. Hiking or eliminating that cap, advocates say, would create a fairer system and increase revenue.

The drawback: Critics of this solution claim that increasing taxes on middle- and upper-income earners would reduce their income and stifle the country’s economic growth.

Related: 6 Popular Social Security Myths Busted

3. Institute a means test. While the vast majority of recipients (80 percent, per AARP) rely on Social Security as an integral part of funding their retirement, extremely high net worth individuals don’t need the additional income. This solution would create a net worth or retirement income threshold over which eligibility for social security phases out.

The drawbacks: It could be politically difficult to settle on a threshold, which might vary depending on the geography of a recipient. Plus, this would require people to pay into a system from which they get no benefits.

4. Freeze the cost of living adjustment. Social Security payments have historically been adjusted based on inflation as measured by the Consumer Price Index. This has been minimal in recent years, but the long-term, compounding effect of inflation makes this provision incredibly expensive.The drawbacks: For many people, Social Security is the only inflation-linked retirement income stream that they have. Limiting it could push some retirees over the financial edge as prices rise.

3 Dumb Moves That Can Hurt Your Career

What's the most common way to breach workplace etiquette and curb your career growth, if not derail it altogether?

AccountTemps says employers and staffers don't always see office etiquette the same. But bosses certainly have more leverage in the matter, since they can fire employees who buck the rules, and a company survey finds U.S. chief financial officers are most often bugged by workers "being distracted" on the job (27% of CFOs say so) and "gossiping about colleagues" (18%).

Other top offenses cited by CFOs:

- Not responding to calls or emails.

- Being late to meetings, or missing them.

- Not crediting other staffers when appropriate.

Employers and workers may not see the top etiquette breaches equally, but they agree on professional decorum more than they disagree, and the shared message is easy to sum up: "Most jobs today require teamwork and strong collaboration skills, and that means following the unwritten rules of office protocol," says Bill Driscoll, a district president of Accountemps. "Poor workplace etiquette demonstrates a lack of consideration for coworkers."

Related: Modern Etiquette: Outclassing the Competition

Of course, the list of workplace professional breaches exceeds the AccountTemps list.

"I've seen it all," notes Nicole Williams, a workplace consultant and a career contributor to NBC's The Today Show. "Employees who lie on expense reports; who badmouth the company or boss on social media or to clients; proofreading mistakes; missing deadlines. Just to name a few."

If you do trip up on the job, it's best to be accountable. "If you really screw up, you have to suffer the consequences in silence," Williams says. "Don't protest, don't try and get out of it, and don't put the blame on someone or something else. People will respect you more for owning your mistakes."

This article originally appeared on Main Street

Read More from Main Street

- 10 Ways to Blow a Job Interview

- The 10 Worst Cities to Enjoy a Summer 'Staycation'

- 12 Universities with the Biggest Endowments

Read more from Main Street: - See more at: http://www.thefiscaltimes.com/2015/05/19/Why-Even-Rich-Millennials-Are-F...

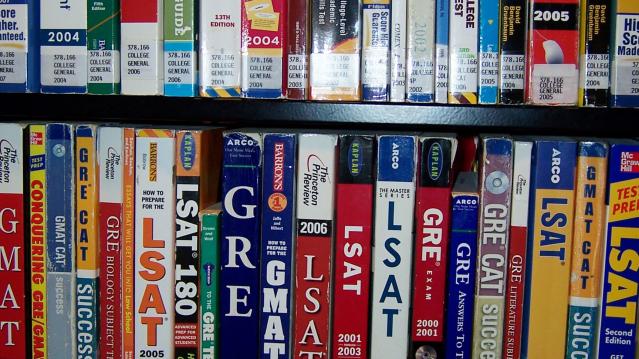

The Lucrative Business of SAT Test Prep Is About to Get Disrupted

For years, critics of the SAT have claimed that wealthy students who can afford expensive, private test prep courses have a leg up on poorer students without access to such classes.

That just changed. Starting yesterday, all students can access free, high-quality online test prep via a new partnership between the College Board, which administers the test, and online course powerhouse Khan Academy, a nonprofit supported by the Bill and Melinda Gates Foundation and Ann and John Doerr among others. The online program will include quizzes, video lessons and personalized lessons.

The Official SAT Practice will focus on the recently redesigned SAT, with questions created by the tests’ authors.

Related: SAT Tests: Another Drain on the Family Budget

College test preparation is a $4.5 billion business. Private SAT tutors charge in excess of $100 per hour and classes from companies like Kaplan or Princeton Review run about $1,000. And those classes may help. Students from the wealthiest families have average test scores that are more than 300 points higher than students from the poorest families on average, according to the College Board.

In recent years, more colleges have moved away from the SAT and its competitor, the ACT, as a backlash against the tests have grown.

More than 850 schools have made the tests optional for admission, according to advocacy group FairTest, choosing instead to focus on class grades and other factors. A study released last year of undergrads at those schools found no difference in either the GPAs or the graduation rates of students who took the SATs versus those that skipped it.

Gas Prices This Summer Could Be Cheapest Since 2009

Gas prices have been on a tear in recent weeks, hitting a national average this week of $2.75 per gallon, the highest price this year, but they’re poised to fall back down as the summer progresses, according to AAA.

The organization is predicting that the cost of gas could fall to its lowest levels since 2009, which is good news for travelers ready to hit the road. About 60 percent of Americans recently surveyed by AAA said they were more likely to take a long road trip this year is gas prices remain low.

While the national average price of gas remains well below $3 per gallon, and 87 percent of U.S. stations are selling gas for below that benchmark, consumers out west and in Hawaii are paying more. Prices in California are highest at $3.30, followed by Hawaii ($3.70) and Nevada ($3.30).

Related: Gas Prices or Economy, Experts Disagree on What Drives U.S. Demand

The average price for a gallon of gas last month was $2.69 per gallon, nearly a dollar less than the $3.66 it cost last May. Economists have been hoping for months that low energy prices would boost consumer spending, but Americans have been choosing to sock away their extra cash rather than spending it.

Personal spending was basically flat in April, falling less than 0.1 percent despite a slight increase in personal income. At the same time, the savings rate increased from 5.2 to 5.6 percent.

Millennial Women are Taking Charge—at Work and at Home

According to a recent report from U.S. Trust, women at the top of the earnings ladder are not only making strides in the workplace, but they’re also taking charge of their households’ finances at higher rates.

The national survey of 640 adults found that among high-net-worth individuals—defined as those with at least $3 million in investable assets—30% of Gen Y women are breadwinners in their households, and another 21% contribute the same amount of income to the household as their partners.

Perhaps even more surprising? That’s true for Millennial women more than any other demo.

Related: How Millennials Could Damage the U.S. Economy

Compare that to the 11% of Gen X women and 15% of Baby Boomer women who earned more than their husbands.

Likely a result, young women have a greater influence over their family’s money decisions than ever. Among today’s high-earning female Millennials, 31% are the primary decision-makers when it comes to their household’s wealth and investment planning. That’s considerably more than the 11% of Gen Xers and 9% of Boomer women who can say the same.

Of course, these role changes don’t just affect women. As moms continue to earn more, about one in four Millennial fathers are more likely to be the primary caretakers of their children—a striking difference from the 7% of Gen X and 3% of Boomer dads who’ve undertaken the same responsibility.

When Will the Consumer Spending Surge Finally Happen?

Economists have been waiting for a surge in consumer spending fueled by savings at the gas pump and a stronger job market boosting personal incomes. They’re going to have to keep waiting.

The Commerce Department on Monday said personal spending was essentially flat in April —it fell less than 0.1 percent — even as personal income rose a better-than-expected 0.4 percent. Americans made more money in April but they didn’t spend more. Instead, they socked it away, raising the savings rate — personal savings as a percentage of disposable income — from 5.2 percent in March to 5.6 percent in April.

Related: How Obamacare Could Be Squeezing Consumer Spending

The April spending picture was the reverse of that from March, when incomes growth stalled but spending rose. Overall, though, Americans still look to be hesitant about opening up their wallets.

“This report clearly indicates that the bounce back in March did not continue into April,” Chris G. Christopher, Jr., director of consumer economics at HIS Global Insight, said in a note to clients. “It is becoming blatantly obvious that the so-called consumer gasoline price dividend is not motivating the average American household to increase their discretionary spending in any meaningful manner.”

Energy prices have risen lately, but they are still down 20 percent from where they were a year ago, notes PNC Senior Macroeconomist Gus Faucher. Eventually, that should still translate to more spending as long as the job market recovery continues apace.

“Clearly, consumption is hardly booming, but the lag between declines in gas prices and the response in the spending numbers is long, typically six or seven months,” Ian Shepherdson, chief economist at Pantheon Macroeconomcs, said in a note to clients. “Gas prices did begin to fall rapidly until November, with the biggest single drop in January, so we don't expect to see consumption accelerate properly until the summer.”

For now, the economists — and the economy — keep waiting.

Top Reads from The Fiscal Times:

- What's Next for Oil Prices? Look Out Below!

- We Just Went Through the Worst Month Since the Great Recession

- Boomers, It's Time to Cash Out of This Bubble