This Is America’s Favorite Credit Card

According to consumers, it does pay to Discover.

For the second year in a row, Discover has ranked the highest in customer satisfaction among credit card issuers, according to the results of a new survey by J.D. Power.

Discover received a score of 828 out of 1,000 in the survey, based on credit card terms, billing and payment, rewards, benefits and services, and problem resolution. American Express placed second with a score of 820, and Chase ranked third at 792.

Overall satisfaction with credit cards hit a record high of 790, up from 778 last year.

Related: 3 High-Tech Ideas to Fraud-Proof Our Credit Cards

Consumers were more likely to use their rewards last year, with more than half having done so in the past six months. That could be because rewards are getting better as banks get more creative with wooing and keeping customers, many of whom are still lukewarm about spending.

“When customers feel the rewards are attractive and when they redeem rewards more frequently, satisfaction improves, they spend more, and they are more likely to recommend the card to friends and family members,” Jim Miller, J.D. Power senior director of banking services, said in a statement.

Customers who redeem rewards spend an average of $1,128 per month, compared to $645 by those who don’t redeem rewards.

Even though they’re more satisfied with their credit cards, Americans are still concerned about ID theft. Less than a third of those surveyed felt their personal information was very secure, and just 16 percent thought that security had improved since last year.

Top Reads from the Fiscal Times:

- Trump: ‘I’ve Gained Such Respect for the People That Like Me’

- Why McDonald’s Could Suddenly Be Responsible for Millions of New Employees

- Americans Want Medicare to Negotiate Better Deals on Drugs

This Is the Most Annoying Thing About Customer Service

The number of Americans fed up with lousy customer service is decreasing but there are still some practices that irritate nearly everyone, according to a newly published report in Consumer Reports’ September issue.

There was a tie for the top customer service complaint. Seventy-five per percent of shoppers surveyed were annoyed by the inability to get a live person on the phone and by dealing with a representative who was rude or condescending.

Seventy-four percent of consumers said they were highly annoyed at being disconnected from a customer service rep, and 71 percent were dissatisfied that they’d been disconnected and then unable to reach the same representative again.

“Many companies today are simply awful at resolving customer protections, despite investments in whiz-bang technologies and considerable advertising about their customer focus,” Scott Broetzman, president of Customer Care Measurement & Consulting, told the magazine.

In a separate report released this week, 24/7 Wall Street found that Amazon.com is the best big company for customer service, followed by Chick-fil-A and Apple. The companies in the publication’s “Customer Service Hall of Shame” include Bank of America, DirectTV and Comcast.

In order to get the best possible customer service, Consumer Reports recommends using the phone, rather than email; showing—and asking for—empathy; and escalating when necessary.

The magazine also suggests putting technology to work. The website Dial a Human can help find the best customer service number for a company, and the service Lucy Phone lets you enter a company’s name and number and then calls you when a rep becomes available so you don’t have to wait on hold.

Top Reads From The Fiscal Times:

- The Next Debt Crisis Could Be Much Worse than in 2013, GAO Warns

- The New Generation of ‘Genuinely Creepy’ Electronic Devices

- Who Are These People Giving Money to Donald Trump?

The Weakest Economic Recovery Since World War II Putters Along

New GDP data released today shows an economy that continues to grow, though at a disappointingly moderate pace.

The good news is that GDP growth picked up after the weak, snow-encrusted first quarter of 2015, when the economy eked out a 0.6 percent growth rate. The bad news is that growth was expected to hit a 2.5 percent rate or better in the second quarter, but initial estimates arriving today pegged that rate at 2.3 percent. Over the first six months of the year, the economy has expanded at an annual rate of 1.5 percent.

The U.S. recession officially ended in the second quarter of 2009. Since then, growth has been relatively steady but lackluster. Compared to other recoveries since the end of World War II, the current recovery is notably weak – without question the weakest of the bunch. The average annual growth rate from 2011 through 2014 was 2.0 percent, based on updated figured released today.

Economists have argued about the causes — a glut of capital, excessive regulation, the domination of finance, low wages driving weak demand — but the simple fact remains: This is a feeble recovery.

This graphic we produced on the Federal Reserve Bank of Minneapolis’s website tells the story – look for the bright red line:

Top Reads from The Fiscal Times:

- The Kids Aren't Alright: More Millenials Are Living with Their Parents

- How Millenials Could Damage the U.S. Economy

- The Pain the Job Numbers Don’t Show

The Shocking Secret About How Your Car Insurance Rate Gets Set

Most drivers probably know that if they get into an accident, their insurance rates are also likely to take a hit. But a new analysis by Consumer Reports finds that your car insurance premiums are increasingly based on factors such as your credit score that are unrelated to your driving record.

How well you drive may actually have little connection to how much you pay for insurance, the consumer group found.

In a two-year investigation, Consumer Reports analyzed more than 2 billion insurance price quotes obtained from more than 700 insurers across the country. It found that in many states a bad credit history will drive up your insurance premiums more than a drunk driving conviction.

“What we found is that behind the rate quotes is a pricing process that judges you less on driving habits and increasingly on socioeconomic factors,” the consumer organization reports. “These include your credit history, whether you use department-store or bank credit cards, and even your TV provider. Those measures are then used in confidential and often confounding scoring algorithms.”

Consumer Reports says it found that most car insurance companies use about 30 elements of the nearly 130 available in a credit report to construct their own secret score for policyholders, and that credit scores could have more of an impact on premiums than any other factor. Drivers with the best credit scores were charged up to $526 less than similar drivers with only “good” scores, depending on where they lived. Only three states — California, Hawaii and Massachusetts — prohibit insurers from factoring in credit scores when setting prices.

Drivers are legally required to carry car insurance, but the lack of pricing transparency makes it harder for them to make informed decisions about which policy to buy. “Because insurance companies are under no obligation to tell you what score they have cooked up for you, you have no idea whether you have a halo over your head or a bull’s-eye on your back for a price increase,” Consumer Reports says.

Industry advertising that promotes special discounts, such as for bundling home and car insurance, only muddles the purchasing process because those special deals don’t actually save people much money, Consumer Reports found.

The organization says it’s high time for truth in car insurance, and it’s asking consumers to sign a petition demanding that insurers -- and the state regulators who oversee them -- use price-setting practices that are tied to more meaningful factors, like driving records. It is also asking consumers to tweet the National Association of Insurance Commissioners, @NAIC_News, and tell them to “Price me by how I drive, not by who you think I am! #FixCarInsurance.”

For more information on state-by-state insurance premiums, or to sign the Consumer Reports petition, go to ConsumerReports.org/FixCarinsurance.

Top Reads From The Fiscal Times:

- Americans Are About to Get a Nice Fat Pay Raise

- How Millenials Could Damage the U.S. Economy

- The Pain the Job Numbers Don’t Show

The Kids Aren’t Alright: More Millennials Are Living with Their Parents

Pity the millennial, poster child of the Great Recession. A popular meme portrays the typical millennial as a basement-dwelling economic loser, forever condemned to live in the nether regions of his parent’s house. Unfortunately, that meme is not without basis. The recession seem to have hit millennials particularly hard, making it even more difficult for young people to find good jobs and to establish their own households.

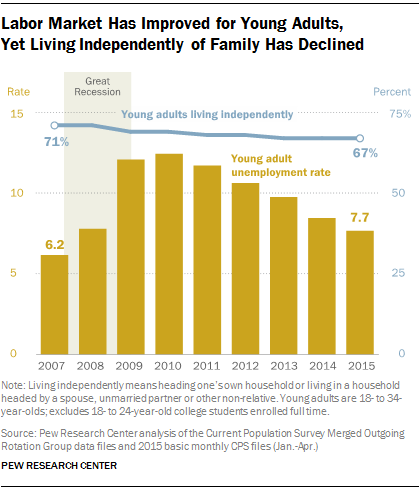

In some respects, things are looking up for millennials. The U.S. job market is strengthening, making it easier to find work, and wages are starting to creep higher. The unemployment rate for young adults (ages 18 to 34, excluding full-time college students) has been heading lower since peaking near 12 percent in 2010; the latest unemployment reading for millennials is 7.7 percent.

However, there is one notable sticking point, and it echoes that basement-dwelling meme. Even though household formation rates have rebounded overall, millennials are still not moving out and establishing their own households like they used to. In fact, more millennials are living with parents or relatives than before the recession, according to new research from Pew.

In 2007, before the recession hit, 71 percent of millennials were living independently. In 2015, that number has fallen to 67 percent, with no sign of bottoming.

On the flip side, 22 percent of young adults were living in their parents’ homes in 2007. That number has risen to 26 percent this year.

The Pew report doesn’t look at why millennials are sticking so close to home. However, it does suggest that the relatively simple economic argument about the lack of good jobs no longer tells the whole story. Since the economy is recovering, however unevenly, there are likely other factors in play. One could be cultural: More young people simply enjoy living at home and are in no hurry to move out. Perhaps the U.S. is becoming more like Italy, where adult children often live at home until they marry.

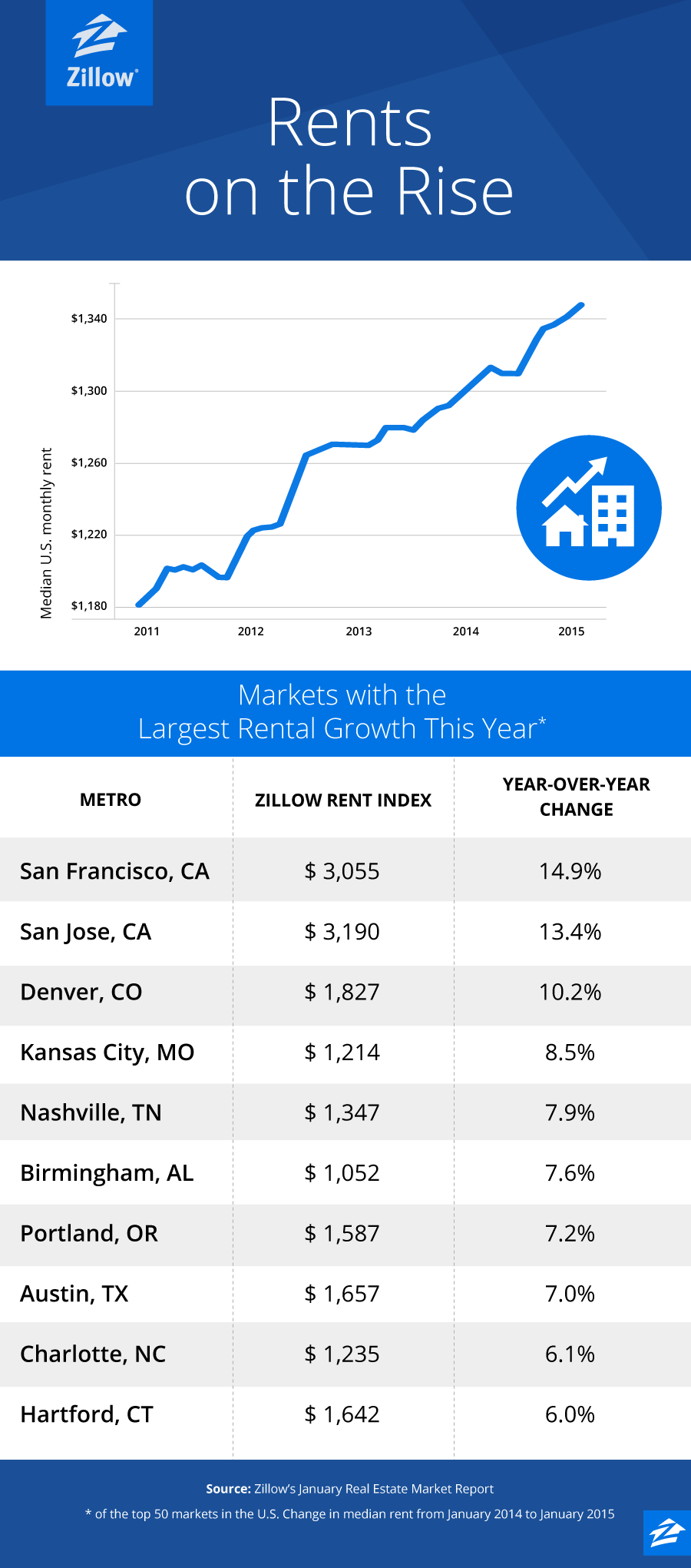

That’s not to say that money plays no role in the trend, though. One big economic factor not addressed in the Pew report is pretty basic: rising rents. This graphic from Zillow makes it clear that rents have been soaring all over the country. More than $3,000 for a one bedroom in San Francisco? With those kind of numbers, living at home makes all the sense in the world.

DOJ Indicts Democratic Lawmaker for Corruption

Martin Matishak, The Fiscal Times

The Justice Department has indicted Rep. Chaka Fattah (D-PA) on almost 30 federal counts of political corruption.

The 11-term congressman and four associates were indicted on 29 federal charges, including bribery, money laundering, falsification of records, and multiple counts of bank and mail fraud, the department announced Wednesday.

Related: Billions in Unfinished Business as Congress Heads Out for Vacation

The charges against Fattah and his associates stem from his failed run for Philadelphia mayor in 2007.

Fattah and the others "embarked on a wide-ranging conspiracy involving bribery, concealment of unlawful campaign contributions and theft of charitable and federal funds to advance their own personal interests,” according to Assistant Attorney General Leslie R. Caldwell.

Justice alleges that Fattah borrowed $1 million from a wealthy donor during his mayoral bid and that he returned $400,000 in unused funds and developed a scheme to repay the remaining $600,000 by tapping charitable and federal grants through a local non-profit the Pennsylvania lawmaker created.

Federal officials also allege that the Fattah sough to repay supporters by offering federal grants and used funds from both his mayoral and congressional campaigns to pay down his son's student loan debts of around $23,000.

"Public corruption takes a particularly heavy toll on our democracy because it undermines people’s basic belief that our elected leaders are committed to serving the public interest, not to lining their own pockets,” she said in a statement.

House Minority Leader Nancy Pelosi (D-CA) said that Fattah has stepped down as the top Democrat on the House Appropriations Commerce, Justice, Science and Related Agencies subcommittee.