How IBM Is Making Your Passwords Useless

For years, quantum computing has been hailed as a technology that could change the way the modern world works, but a long-standing technical issue has kept that potential from being realized. Now, in a paper published in the journal Nature last week, IBM scientists have taken a big step (see how I avoided the temptation to make a pun there?) toward solving that problem — and while it could represent progress toward making quatum computers real, it also could mean that current cybersecurity standards will soon be much easier to crack. In other words, your passwords could be obsolete soon.

The power of quantum computing has some obvious appeal: The increase in processing power could speed up research, especially in big data applications. Problems with large datasets, or those that need many millions (or billions, or more) of simulations to develop a working theory, would be able to be run at speeds unthinkable today. This could mean giant leaps forward in medical research, where enhanced simulations can be used to test cancer treatments or work on the development of new vaccines for ebola, HIV, malaria and the other diseases. High-level physics labs like CERN could use the extra power to increase our understanding of the way the universe at large works.

But the most immediate impact for the regular person would be in the way your private information is kept safe. Current encryption relies on massively large prime numbers to encode your sensitive information. Using combinations of large prime numbers means that anyone trying to crack such encryption needs to attempt to factor at least one of those numbers to get into encrypted data. When you buy something from, say, Amazon, the connection between your computer and Amazon is encrypted using that basic system (it's more complicated than that, but that's the rough summary). The time it would take a digital computer to calculate these factors is essentially past the heat death of the universe. (Still, this won't help you if your password is password, or monkey, or 123456. Please, people, use a password manager.)

Quantum computing, however, increases processing speed and the actual nature of the computation so significantly that it reduces that time to nearly nothing, making current encryption much less secure.

The IBM researcher that could make that happen is complicated, and it requires some background explanation. For starters, while a "traditional" computing bit can be either a 0 or a 1, a quantum computing bit can have three (or infinite, depending on how you want to interpret the concept) states. More specifically, a qubit can be 0, 1, or both.

Up until now, the both part of that caused some problems in realizing the power of quantum computing.

Up until now, the both part of that caused some problems in realizing the power of quantum computing.

Apparently — and you'll have to take this on faith a bit, as it hurts my head to think about it — the both state can switch back to either 0 or 1 at any given point, and sometimes incorrectly, based on the logic in the programming. Think about when your phone freezes up for a second or two while you're matching tiles. This is its processor handling vast amounts of information and filtering out the operations that fail for any number of reasons, from buggy code to malware to basic electrical noise. When there are only the two binary states, this is a process that usually happens behind the scenes and quickly.

The hold-up with quantum computing up until now is that the vastly greater potential for errors has stymied attempts to identify and nullify them. One additional wrinkle in this reading quantum states is familiar to anyone with basic science fiction knowledge, or perhaps just the ailurophobics. What if the action of reading the qubit actually causes it to collapse to 0 or 1?

The very smart people at IBM think they've solved this. The actual technical explanation is involved, and well beyond my ability to fully follow, but the gist is that instead of just having the qubits arrayed in a lattice on their own, they are arranged such that neighbors essentially check each other, producing the ability to check the common read problems.

That opens the door to further quantum computing developments, including ones that will make your password a thing of the past. So, does this mean that you need to start hoarding gold? No, not yet. And hopefully before quantum computing reaches commercial, or even simply industrial/governmental levels, a better cyber security method will be in place. Or the robots will have already taken over. I for one welcome them.

Facebook Is Testing a Solar-Powered Internet-Beaming Drone

Imagine looking up at the sky and seeing a 900 lb. drone the size of Boeing 737 moving in slow circles 11 miles above you. As part of Facebook’s plan to provide Internet access to the 4 billion people who currently lack it, that could soon be the reality for the 10 percent of Earth’s population that lives far from cell towers or fiber optic lines.

Researchers at Facebook’s Connectivity Lab, a division of Facebook’s Internet.org, announced yesterday that the first such drone has been completed as a step toward building a larger fleet. The craft hasn’t been flown yet, but Facebook has been testing versions one-tenth the size over the U.K. and plans on beginning flight tests of the full-size craft before the end of this year.

Related: 12 Weird Uses for Drones

The drone, termed Aquila (Latin for “Eagle), is a solar-powered V-shaped carbon fiber craft that will carry equipment such as solar panels and communications gear that can beam down wireless Internet connectivity. Lacking wheels or the ability to climb, the drone will be launched using helium balloons and will be able to fly for 90 days at a time.

One of the biggest breakthroughs in the project has been the team developing a way to increase the data capacity of the lasers involved. The new system allows a ground-based laser to transmit information to a dome on the underside of the plane at 10 GB per second, about 10 times faster than previously thought possible.

Facebook’s mission isn’t without controversy. Worldwide, critics have been questioning many of Internet.org’s practices on privacy, fairness and security grounds. Those opponents fear that users of Internet.org might be monitored through state-run telecoms, in some cases allowing countries to spy on and repress their citizens. In addition, first-time users of the Internet might confuse Facebook for the entire Internet and only receive news and information from the one site.

The flack Internet.org is receiving isn’t the only problem Facebook has to deal with. Rival Google also has a project in the works to bring wireless Internet to rural communities. Their program, called “Project Loon,” involves high-altitude helium balloons that have transmitters attached to them. Although the project hasn’t been launched yet, it’s in more advanced stages than Aquila.

Watch the video from Facebook’s Connectivity Lab:

This Is the Most Annoying Thing About Customer Service

The number of Americans fed up with lousy customer service is decreasing but there are still some practices that irritate nearly everyone, according to a newly published report in Consumer Reports’ September issue.

There was a tie for the top customer service complaint. Seventy-five per percent of shoppers surveyed were annoyed by the inability to get a live person on the phone and by dealing with a representative who was rude or condescending.

Seventy-four percent of consumers said they were highly annoyed at being disconnected from a customer service rep, and 71 percent were dissatisfied that they’d been disconnected and then unable to reach the same representative again.

“Many companies today are simply awful at resolving customer protections, despite investments in whiz-bang technologies and considerable advertising about their customer focus,” Scott Broetzman, president of Customer Care Measurement & Consulting, told the magazine.

In a separate report released this week, 24/7 Wall Street found that Amazon.com is the best big company for customer service, followed by Chick-fil-A and Apple. The companies in the publication’s “Customer Service Hall of Shame” include Bank of America, DirectTV and Comcast.

In order to get the best possible customer service, Consumer Reports recommends using the phone, rather than email; showing—and asking for—empathy; and escalating when necessary.

The magazine also suggests putting technology to work. The website Dial a Human can help find the best customer service number for a company, and the service Lucy Phone lets you enter a company’s name and number and then calls you when a rep becomes available so you don’t have to wait on hold.

Top Reads From The Fiscal Times:

- The Next Debt Crisis Could Be Much Worse than in 2013, GAO Warns

- The New Generation of ‘Genuinely Creepy’ Electronic Devices

- Who Are These People Giving Money to Donald Trump?

The Weakest Economic Recovery Since World War II Putters Along

New GDP data released today shows an economy that continues to grow, though at a disappointingly moderate pace.

The good news is that GDP growth picked up after the weak, snow-encrusted first quarter of 2015, when the economy eked out a 0.6 percent growth rate. The bad news is that growth was expected to hit a 2.5 percent rate or better in the second quarter, but initial estimates arriving today pegged that rate at 2.3 percent. Over the first six months of the year, the economy has expanded at an annual rate of 1.5 percent.

The U.S. recession officially ended in the second quarter of 2009. Since then, growth has been relatively steady but lackluster. Compared to other recoveries since the end of World War II, the current recovery is notably weak – without question the weakest of the bunch. The average annual growth rate from 2011 through 2014 was 2.0 percent, based on updated figured released today.

Economists have argued about the causes — a glut of capital, excessive regulation, the domination of finance, low wages driving weak demand — but the simple fact remains: This is a feeble recovery.

This graphic we produced on the Federal Reserve Bank of Minneapolis’s website tells the story – look for the bright red line:

Top Reads from The Fiscal Times:

- The Kids Aren't Alright: More Millenials Are Living with Their Parents

- How Millenials Could Damage the U.S. Economy

- The Pain the Job Numbers Don’t Show

The Shocking Secret About How Your Car Insurance Rate Gets Set

Most drivers probably know that if they get into an accident, their insurance rates are also likely to take a hit. But a new analysis by Consumer Reports finds that your car insurance premiums are increasingly based on factors such as your credit score that are unrelated to your driving record.

How well you drive may actually have little connection to how much you pay for insurance, the consumer group found.

In a two-year investigation, Consumer Reports analyzed more than 2 billion insurance price quotes obtained from more than 700 insurers across the country. It found that in many states a bad credit history will drive up your insurance premiums more than a drunk driving conviction.

“What we found is that behind the rate quotes is a pricing process that judges you less on driving habits and increasingly on socioeconomic factors,” the consumer organization reports. “These include your credit history, whether you use department-store or bank credit cards, and even your TV provider. Those measures are then used in confidential and often confounding scoring algorithms.”

Consumer Reports says it found that most car insurance companies use about 30 elements of the nearly 130 available in a credit report to construct their own secret score for policyholders, and that credit scores could have more of an impact on premiums than any other factor. Drivers with the best credit scores were charged up to $526 less than similar drivers with only “good” scores, depending on where they lived. Only three states — California, Hawaii and Massachusetts — prohibit insurers from factoring in credit scores when setting prices.

Drivers are legally required to carry car insurance, but the lack of pricing transparency makes it harder for them to make informed decisions about which policy to buy. “Because insurance companies are under no obligation to tell you what score they have cooked up for you, you have no idea whether you have a halo over your head or a bull’s-eye on your back for a price increase,” Consumer Reports says.

Industry advertising that promotes special discounts, such as for bundling home and car insurance, only muddles the purchasing process because those special deals don’t actually save people much money, Consumer Reports found.

The organization says it’s high time for truth in car insurance, and it’s asking consumers to sign a petition demanding that insurers -- and the state regulators who oversee them -- use price-setting practices that are tied to more meaningful factors, like driving records. It is also asking consumers to tweet the National Association of Insurance Commissioners, @NAIC_News, and tell them to “Price me by how I drive, not by who you think I am! #FixCarInsurance.”

For more information on state-by-state insurance premiums, or to sign the Consumer Reports petition, go to ConsumerReports.org/FixCarinsurance.

Top Reads From The Fiscal Times:

- Americans Are About to Get a Nice Fat Pay Raise

- How Millenials Could Damage the U.S. Economy

- The Pain the Job Numbers Don’t Show

The Kids Aren’t Alright: More Millennials Are Living with Their Parents

Pity the millennial, poster child of the Great Recession. A popular meme portrays the typical millennial as a basement-dwelling economic loser, forever condemned to live in the nether regions of his parent’s house. Unfortunately, that meme is not without basis. The recession seem to have hit millennials particularly hard, making it even more difficult for young people to find good jobs and to establish their own households.

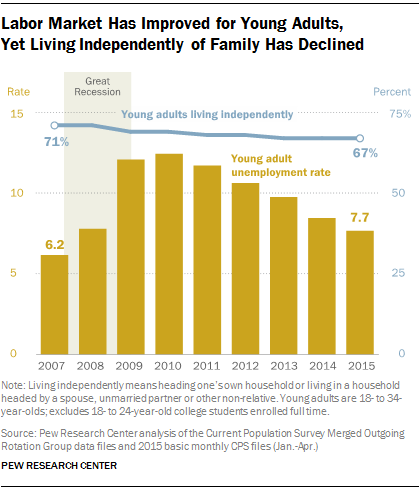

In some respects, things are looking up for millennials. The U.S. job market is strengthening, making it easier to find work, and wages are starting to creep higher. The unemployment rate for young adults (ages 18 to 34, excluding full-time college students) has been heading lower since peaking near 12 percent in 2010; the latest unemployment reading for millennials is 7.7 percent.

However, there is one notable sticking point, and it echoes that basement-dwelling meme. Even though household formation rates have rebounded overall, millennials are still not moving out and establishing their own households like they used to. In fact, more millennials are living with parents or relatives than before the recession, according to new research from Pew.

In 2007, before the recession hit, 71 percent of millennials were living independently. In 2015, that number has fallen to 67 percent, with no sign of bottoming.

On the flip side, 22 percent of young adults were living in their parents’ homes in 2007. That number has risen to 26 percent this year.

The Pew report doesn’t look at why millennials are sticking so close to home. However, it does suggest that the relatively simple economic argument about the lack of good jobs no longer tells the whole story. Since the economy is recovering, however unevenly, there are likely other factors in play. One could be cultural: More young people simply enjoy living at home and are in no hurry to move out. Perhaps the U.S. is becoming more like Italy, where adult children often live at home until they marry.

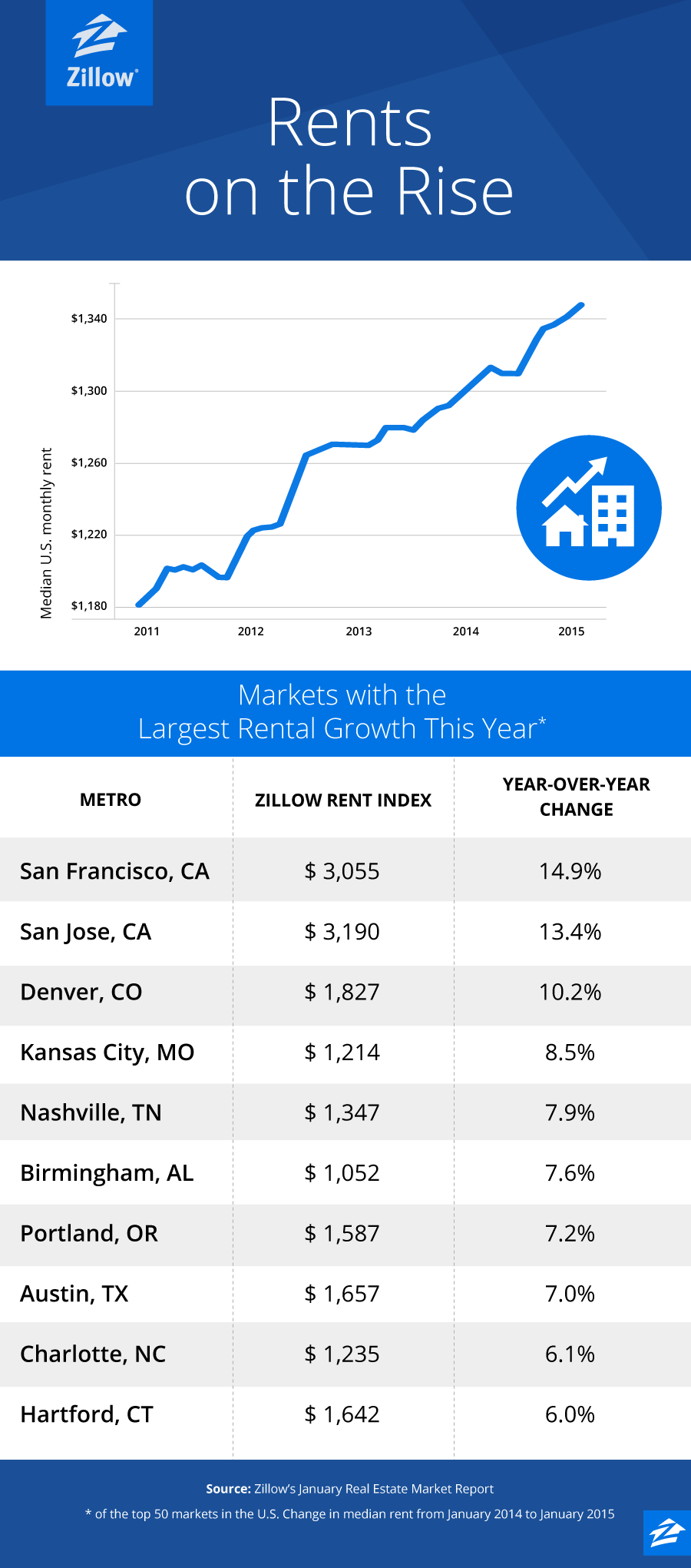

That’s not to say that money plays no role in the trend, though. One big economic factor not addressed in the Pew report is pretty basic: rising rents. This graphic from Zillow makes it clear that rents have been soaring all over the country. More than $3,000 for a one bedroom in San Francisco? With those kind of numbers, living at home makes all the sense in the world.